Surfactants Monthly - November 2025

Surfactants Monthly – November 2025

Big news in bio-based surfactants: I’m collaborating with the great Doris De Guzman to produce the definitive market report on bio-based surfactants, including the most comprehensive assessment of every known company involved in the field throughout the world. It publishes January 12th. To get on the advance order list contact Doris at admin@greendma.com. Here’s a link to the press release in full:

November saw our 11th Asian Surfactants Conference in KL, which was great. Here are five takeaways from the week – which you may find interesting as I know many of you already have.

Next up, we are back at a new venue in Jersey City for our 16th World Surfactants Conference, May 6 – 7th (Training on the 5th). Register here and take advantage of the early bird pricing. https://events.icis.com/website/8544/

End of relentless self-promotion.

Macroeconomics:

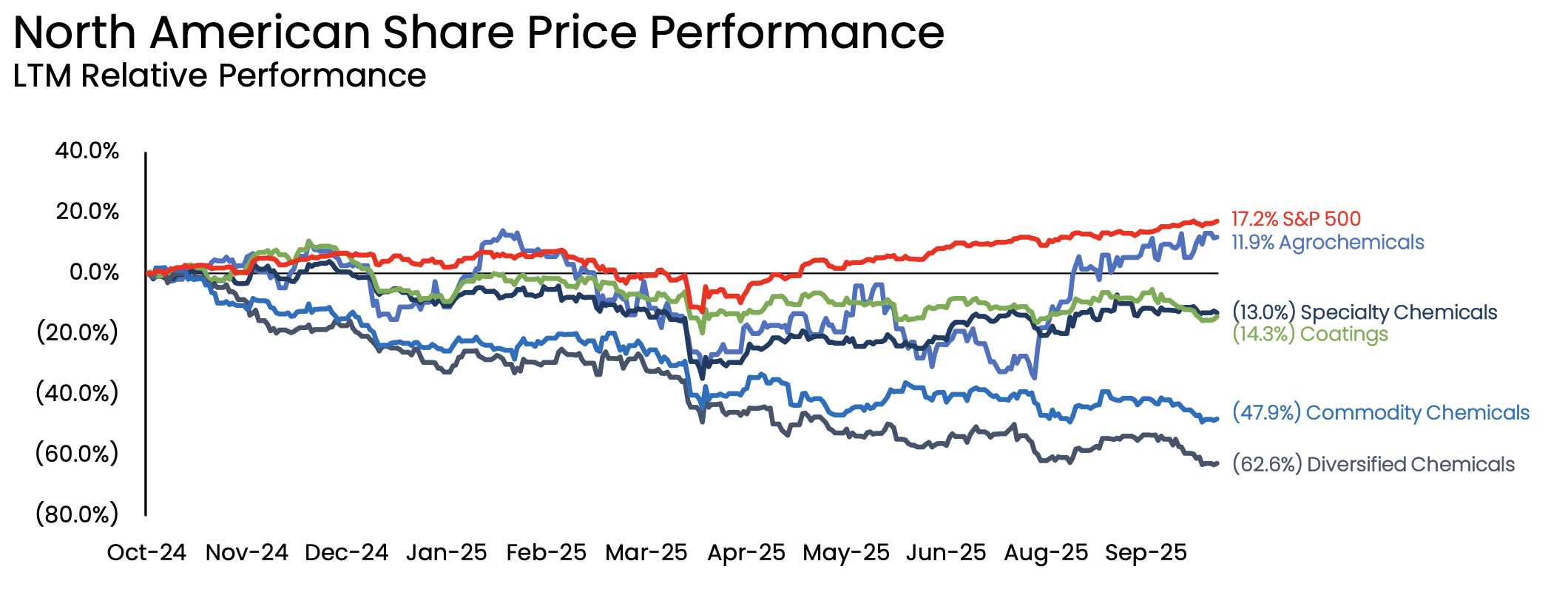

The great chemicals focused investment bank, Balmoral, recently published Q3 chemicals newsletter. First some telling graphs:

Every single North American chemical sector is underperforming the S&P

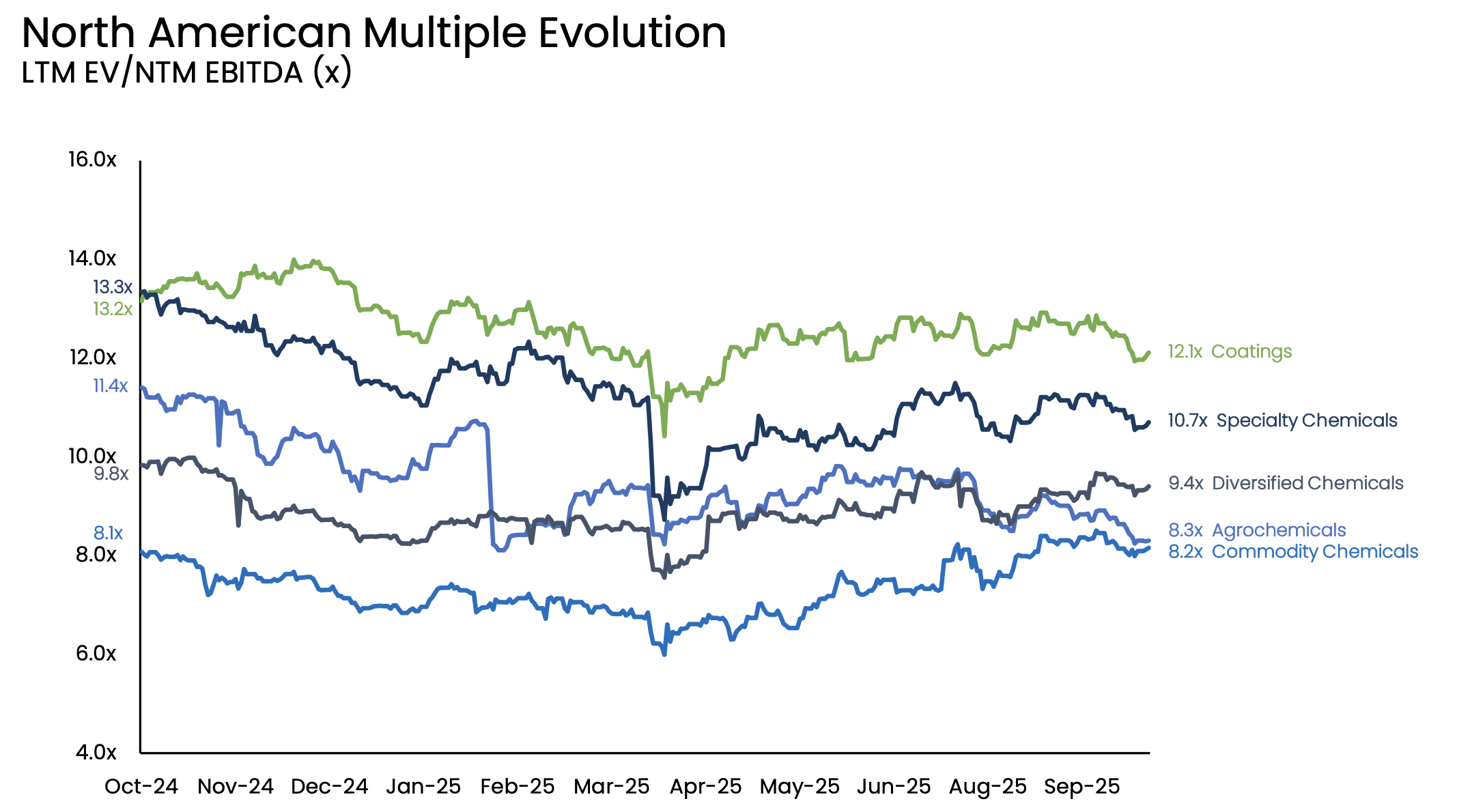

North American EBITDA multiples – down.

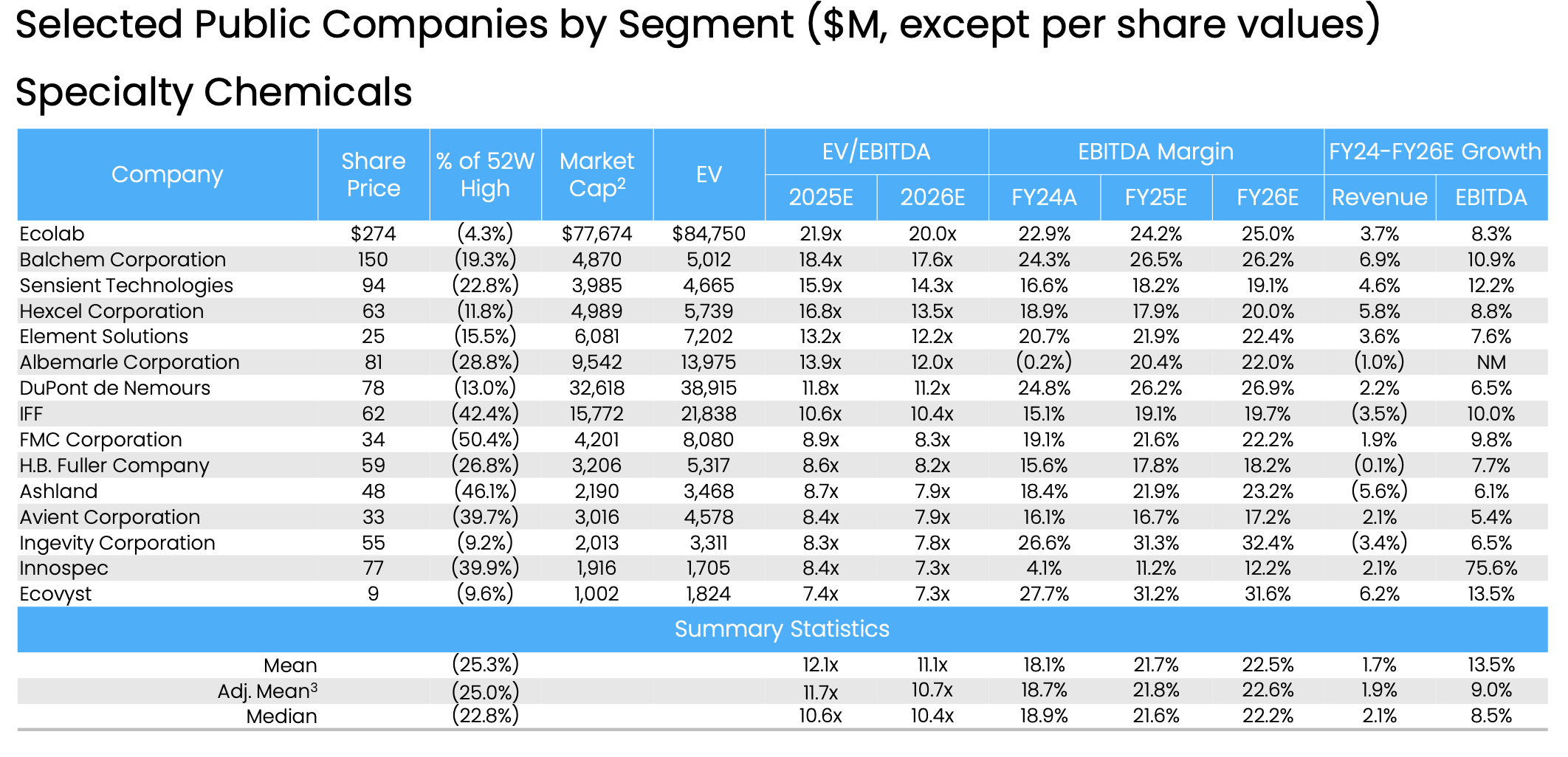

Every single chemical stock is well off of its 52 week high. Here’s a small sample of N. American specialties.

Elsewhere in the report, which you should read in full here (https://balmoraladvisors.com/wp-content/uploads/2025/11/2025-Q3-Chemicals-Industry-Newsletter.pdf) :

M&A Deal Failure Rates: Valuation friction intensified significantly in Q3, with approximately 60% of active M&A processes failing to clear due to bid–ask gaps, a marked increase from the historical failure rate of 15–20%.

Valuation Multiples: Public commodity chemicals traded near mid-cycle averages of approximately 8x EV/EBITDA, while specialty and coatings segments traded between 10–12x; however, high-quality private assets with visible growth profiles continued to transact in the 12–16x range.

Private Equity Holding Periods: The median holding period for private equity-owned chemical companies increased to a high of 5–6 years, indicating a constrained exit environment and rising pressure on funds to return capital.

Global Transaction Volume: Disclosed deal volume slowed to 103 closed transactions in Q3 2025, down from 109 in Q2, with the Asia/Pacific region driving the plurality of activity at 37% of total volume.

Let’s just make an unambiguous plug for Balmoral. I’ve worked with them in the past and they are excellent. If you are thinking of buying or selling a chemicals, materials or industrial business – or have capital raising needs, you should talk to Balmoral (https://balmoraladvisors.com/). BTW this is an unsolicited endorsement. They are not sponsors or anything like that.

Something else Macro – The Fed’s delightfully named beige book was published yesterday, here. In summary:

Overall Economic Activity: Economic activity was largely unchanged across the twelve Federal Reserve Districts, with two Districts reporting modest declines and only one reporting modest growth amid generally flat or pessimistic outlooks.

Consumer Spending: Overall spending declined as lower-to-middle-income consumers tightened budgets, though high-end retail spending remained resilient.

Labor Markets: Employment levels fell slightly due to weaker labor demand, with employers managing headcounts primarily through hiring freezes and attrition rather than widespread layoffs.

Prices and Costs: Prices rose at a moderate pace with widespread input cost pressures attributed to tariffs and rising insurance premiums, though businesses faced difficulty passing these full costs to price-sensitive customers.

Government Shutdown Impact: A federal government shutdown disrupted economic activity in several Districts, specifically negatively affecting travel and tourism while increasing demand at community organizations (like food banks) due to delays in SNAP benefit processing.

So – consumer spending. This echoes what we talked about in last months blog from Stepan and P&G. Not a good picture for commodity chemicals (including surfactants). And something else – not political. How sad that folks had to go to food banks to eat because the government couldn't get its act together. How sick is that?

The News:

Stepan reported that it completed the sale of its Philippines operations to Musim Mas (We reported this previously in the blog). The plant, in Bauan, Batangas province will continue to support Stepan customers in the region via a tolling arrangement.

Earlier in the month, Clariant inaugurated an expansion of surfactants and flame retardants at Daya Bay, Huizhou, China, with an investment of approximately $100 million. This expansion increases capacity by 80% for care chemicals, focusing on pharmaceutical excipients and specialty chemicals for personal and home care. A second spray tower was added for south China customers, along with a new reactor.

Evonik and its joint venture partner Sumi Asih have sold their betaines business in Bekasi, Indonesia, to South Korea's Aekyung Chemical, finalizing the sale on 31 October. Financial details were not disclosed. This follows Evonik's divestment of betaines assets in Virginia, US, and Milton Keynes, UK, in 2022. Evonik will maintain its betaines businesses in Europe and Latin America. Clearly, betaines ain’t what they used to be. Very much the commodities rather than the specialities they started life as. Reminds me of this video (particularly around the 2:45 mark) and the associated graph – “Not a Good Place”.

OK what else. Lot’s of stuff this month. I read it first in HAPPI, but it’s all over the news Kimberly Clark will acquire all of the outstanding shares of Kenvue (the new name for J&J’s personal care business) common stock in a cash and stock transaction that values Kenvue at an enterprise value of approximately $48.7 billion, based on the closing price of Kimberly-Clark common stock on October 31, 2025.This transaction brings together two iconic American companies to create a combined portfolio of complementary products, including 10 billion-dollar brands, that touch nearly half the global population through every stage of life, said the company. Mike Hsu (Head of Kimberly-Clark,) will be the Chairman and CEO of the combined company. It’s a big deal and hopefully will result in increased investment and focus on the J&J brands. A potential dark cloud is, of course, all the negativity around Tylenol. Let’s see.

Walmart continues to police directly the ingredients used in the consumer products that it buys. Older readers will recall the company was in the forefront of removing alkylphenol ethoxlates from cleaning products in the US. On October 1st, the company announced it is moving to eliminate synthetic dyes and the use of an additional 30 ingredients, including certain preservatives, artificial sweeteners and fat substitutes from its private brand food products. So – what is affected? I won’t give you the whole list here but in addition to the famous FD&C Red 40 used in Froot Loops (the name alone…), M&Ms, Minute Maid Orange (yes, really) and Cheez Balls (synthetic name, synthetic food) among others, Walmart is banning (from food) Dioctyl Sodium Sulfosuccinate, parabens and Lactylated Esters of Mono & Diglycerides. They warn everyone that yes, unfortunately the foods will still taste the same. Oh well, at least it’s a start.

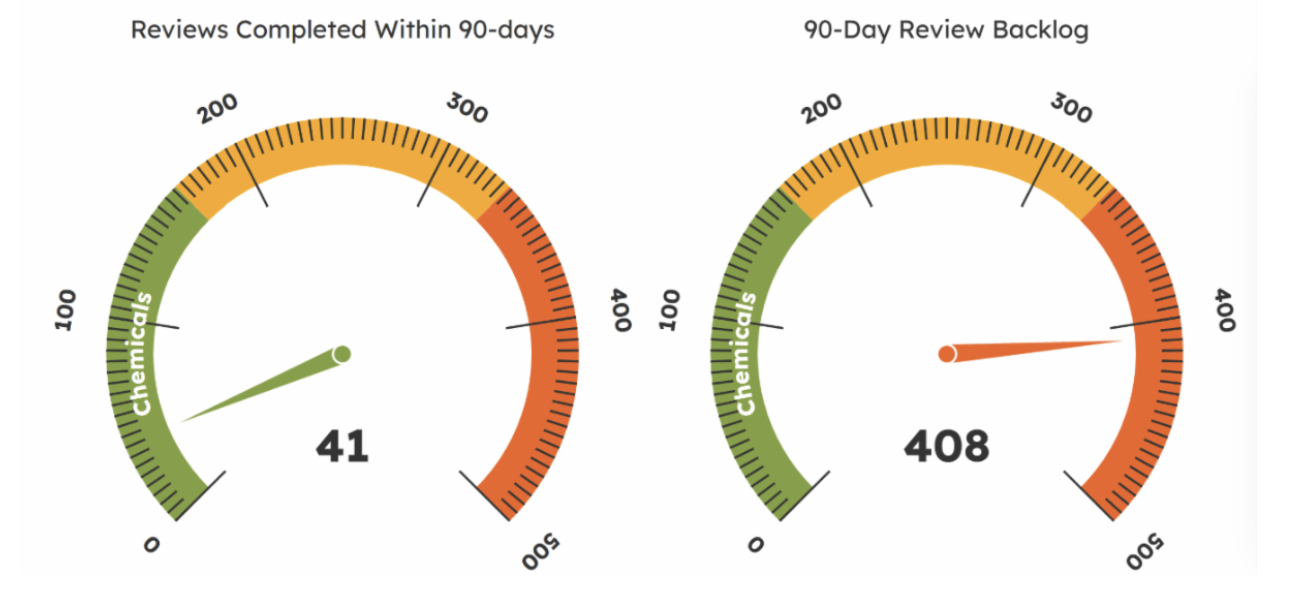

Continuing TSCA woes: I got an email from Omnitech decrying the continuing impact of TSCA delays on innovation in biobased chemicals. While the law mandates a 90-day review, the EPA's backlog means that the majority of PMNs, including those for biobased substances, are held up far longer. A significant percentage of cases are under review for over 365 days. This graphic really hit home.

That’s pretty bad.

A snippet of biosurfactant news: Dispersa (Canadian Sophorolipid startup) has teamed up with long time surfactant distributor, Quadra to distribute their Purasurf products in North America. Read all about it here.

And Dispera themselves announced the inauguration of a new headquarters in Laval Quebec. The company claims to be Canada’s first and only biosurfactant manufacturer [I believe that is the case]. They also claim that PuraSurf™ is the world’s first waste-derived biosurfactant. I’ll leave them to argue that out with Amphistar. Anyway – all this activity is good to see.

We’ve written a fair bit about Mass Balance accounting for biobased products in surfactants. ICIS and the ACC have produced a nice publication available here, entitled Expanding Agricultural Markets and Economic Impact with Mass Balance Accounting. As a reminder: Mass balance accounting allows renewable chemical feedstocks produced from oil grains and fats to be mixed and co-processed with fossil-based ones, while maintaining traceability of these feedstocks in products produced in the chemical value chain. Utilizing mass balance accounting reduces market entry barriers and accelerates time to market for biogenic materials in products like plastics and foams, and gives potential value for sustainably sourced feedstock. The key points from the document ,which considers the hypothetical conversion 10% of US ethylene to a bio mass balance product are:

Economic Opportunity for Farmers: Achieving a 10% non-fossil content target for U.S. ethylene by 2030 using mass balance accounting would create an estimated $6.7 billion market opportunity and support 34,000 permanent jobs for U.S. farmers.

Capital Expenditure Efficiency: The mass balance approach requires approximately $3.2 billion in capital investment to produce 4.2 million tonnes of renewable ethylene, whereas a segregated supply chain would require $9.0 billion to achieve the same output.

Feedstock Demand: The mass balance scenario drives demand for 25.7 million tonnes of oil grains (mainly soy and corn) and 1.2 million tonnes of fats (mainly tallow), compared to the segregated model which utilizes 20.8 million tonnes of oil grains and no fats.

Total Agricultural Impact: When including direct, indirect, and induced economic impacts, the mass balance scenario is projected to generate between $24 billion and $65 billion in total output for the U.S. agriculture sector.

Infrastructure Requirements: Meeting the 10% target via mass balance would require the construction of up to 15 new manufacturing assets (HVO and ethanol dehydration), compared to 30 new plants required for a segregated bioethanol-to-ethylene route.

We’ve also written a fair bit about Product Carbon Footprint here and bemoaned (OK maybe that's an exaggeration) the lack of standardization and the resulting games that people play with PCFs. The WSJ wrote about a new coalition setting out to clean up the system, Carbon Measures, which includes ExxonMobil, BASF, Honeywell, Mitsui and others among the current 19 members. Apparently the new group aims to aims to create an accounting system based on the direct emissions of products and one that avoids the double counting seen in current supply-chain—or Scope 3—reporting. Darren Woods, the CEO of Exxon Mobil, who was speaking ab out the matter in Sao Paulo recently, said that holding a supplier responsible for the emissions of its supply chain was like holding McDonald’s responsible for the weight of its customers. “The only way that an oil and gas company meeting the demands of society today can reduce its Scope 3 emissions is to stop selling product,” he said. Hmm I sense a brewing controversy here and that’s probably not a bad thing. According to the article, the current GHG Protocol calls on companies to report their own emissions and those of companies within their supply chains. Critics say it allows multiple actors to count the same carbon emissions. Let’s keep an eye on this.

Brenntag, a substantial distributor of surfactants (and of course many other chemicals), reported their Q3 results recently and they were, as expected, not great. :

Sales: Generated 3,718 million EUR, a decline of 4.7% (fx-adjusted) compared to Q3 2024.

Operating EBITDA: 330.2 million EUR (down 6.7%).

Market Context: The results reflect a "persistently challenging" macroeconomic environment with no short-term signs of improvement in demand.

No Divisional Separation: A full separation of the two divisions (Brenntag Specialties and Brenntag Essentials) is no longer under consideration. The company decided that keeping them within one Group maximizes synergies in costs, infrastructure, and market access.[I think this may be a missed opportunity]

Governance Overhaul: Effective December 1, 2025, the governance structure will be streamlined. The model of divisional CEOs is being replaced by a two-member Management Board (CEO and CFO) supported by an Executive Committee.

Cost Containment: The program is being accelerated with a target of 300 million EUR in annual savings by 2027.

Measures include reducing organizational complexity, eliminating duplications, and reducing headcounts worldwide (focused on overheads and headquarters).

The company is also evaluating potential site closures and market exits.

Brenntag Specialties: Sales declined by 5.0% to 1,181 million EUR. Both Life Science and Material Science segments saw significant EBITA declines (~17%), driven largely by lower performance in EMEA and North America.

Brenntag Essentials: Sales declined by 4.6% to 2,537 million EUR, impacted by pricing pressure and demand trends.

An article in my well-thumbed copy of Area Development Magazine caught my attention recently. Church and Dwight will expand operations at its Old Fort, OH plant in order to increase production of what they call their unit dose detergent power packs. Interesting. I hopped on over to the C&D website where it’s pretty easy to find out the ingredients. The surfactant hearts of these various products are mainly built on LAS (both sodium and monoethanolamine salts) and alcohol ethoxylates of both petrochemical and oleochemical origins. The classics really. Can’t beat ‘em. Not yet.

We haven’t really talked much about MoCRA here at the blog. What? I hear you ask. Exactly. It’s the Modernization of Cosmetics Regulation Act. It was passed in 2022 but apparently is still in the process of being implemented. Parts not yet in place include:

· Fragrance Allergen Labeling – A rule that would require disclosure of certain fragrance allergens in cosmetic products.

· Talc-Containing Cosmetic Testing – The FDA’s new standardized testing methods for detecting asbestos contamination in talc-based products.

· Good Manufacturing Practices (GMP) for Cosmetics – The FDA was developing formal GMP regulations to ensure the safety and consistency of cosmetic production.

Anyway, HAPPI reports that full implementation of MoCRA is the PCPC’s (Personal Care Product Council) biggest goal for 2026. How come? Regulations are bad right? Well not necessarily. One key area is pre-emption regarding ingredients. Pre-emption is where federal law trumps (oops sorry. Pun not intended) state law. Like when federal law says all new cars should have airbags. MoCRA right now does not preempt any state laws re ingredients in cosmetics and personal care products. So you get things like Washington State banning lead in cosmetics. Well it’s an impurity not an ingredient. No-one’s putting lead in cosmetics since Cleopatra (that may be an exaggeration. Queen Elizabeth I likely did also. Queens! Am I right?). The PCPC would rather see impurities governed by GMP requirements – see bullet #3 above. Makes sense right?

Givaudan, it says here, is launching something they call a laundry serum. How cool does that sound? Apparently it’s an encapsulated fragrance ingredient that is added to laundry to make it smell good. I can’t tell if it’s sold on its own to consumer or to detergent makers who add it to their product. It’s 40% fragrance. No information on what the rest is [Dear Giv people. The tipline is open]. Given Unilever’s stressing of fragrance at their supplier day in April this year, this seems like a timely intro.

The tipline is open…

Don’t know how I missed this, but October’s HAPPI tells me there’s a company called Clean Cult that sells laundry detergent in milk cartons and claims that it’s “free from harsh stuff”. It says they’re refillable (you pour from the carton into a bottle) and sold in Whole Foods. So…. I go on over to the website to see what’s in there. Let’s read the origin story first: “One day, during a particularly powerful spin cycle, our co-founder Ryan, noticed there were no recognizable ingredients listed on his bottle of detergent. You heard us, not one. Intrigued, he did some digging and was shocked to learn of all the artificial chemicals in conventional cleaners, "natural" alternatives weren't much better either, with their toxic plastic packaging, indecipherable ingredients, and let's face it, weak results.” OK then. They also say their cult is non-toxic and the products are made without (among other things) SLS/SLES (cue pantomime villain booing from the cheap seats). Yeah but what about the ingredients? OK so their best-seller laundry detergent is built on Sodium Coco Sulfate (not SLS, heaven forfend), Laureth 7 and Potassium Cocoate. There’s enzymes as well. The handsoap is built on Sodium Coco Sulfate, an APG and CAPB. As for those indecipherable and unrecognizable ingredients? Hmm I dunno. So am I too cynical? I think they’re ill served by their sanctimony (although I’m far from their demographic). The products probably clean OK (not Tide levels but, OK) and the refilling thing I can sympathize with. I kinda like the idea. Although in reality the milk cartons will just end up in the regular garbage – along with, probably every few weeks or so, the supposedly permanent bottle getting thrown out also, resulting in a load of unnecessary money spent on OK detergent. Well, now I feel sorry for them, having made such acerbic observations, so here’s a picture of one of their milk cartons.

Not us…

Alright – here’s something I really do like though. Colin Brown of Mr. Turtle, basically open sources his detergent refilling system in detail on Linkedin. Check it out.

I actually think this might be very important news, so hopefully you’re still reading this far. The great Jay Dawick (Head Toxicology Honcho) of Innospec chaired the CESIO committee which produced, in November, updated recommendations for the classification and labeling of surfactants. It is a huge, densely packed document which they’ve helpfully also made available in a spreadsheet format downloadable from this page. The guide recommends labelling and UN GHS classifications, including those all-important pictograms, for what looks like over 800 commercial surfactants. Wow! I took a look and here are some interesting snippets. I’ll focus just on pictograms for brevity..

· First up good ol’ LAS requires the pictograms GHS05 and 07 – that’s these 2

GHS05

GHS07

· Then SLES: If I read this right for SLES-2 of the usual type and of 30 – 70% concentration, you have to put a GHS07 on there.

· But if it’s SLES-3 then apparently no pictogram is needed. [am I reading that right?]

· What about AOS? For the regular 38 – 40% variety, you’ve got a GHS05

· APG? Of the C1214 variety sold between 30 – 100% active (which is most of it) you have both pictograms (05 and 07) – just like LAS - ouch!

· Isethionates – 07 across the board

· Taurates – the same

So there you have it. I did not see glycolipids (sophorolipid or rhamnolipid biosurfactants) mentioned in there, probably because they are not commercially meaningful enough. There’s likely more to be gleaned from the document. If readers want to comment – please do so.

I don't usually do distributor announcements but here’s Stepan’s announcement that they have an exclusive distribution agreement with Amphistar for the Belgian company’s biosurfactants in EMEA (Europe, Middle East and Africa) for the HI&I market. It says exclusive and so this is a very big deal for Amphistar in the biggest surfactants markets in their home territory of Europe. Readers may recall that Stepan, some years back, bought the Logos Technologies Rhamnolipid technology and has a bio-collaboration track record going back many more years to their deal the then Elevance (now part of Wilmar). I wish much success to both companies.

There are some cynics who claim that my interest in P&G’s new waterless haircare brand, Gemz is merely a pretext for publishing pictures of this rosy-cheeked lass in pretty much every blog for the last 12 months.

Well, not 100% true. I’ve been a fan of waterless products well before Gemz came along and last month P&G published something here that affirms another of my favorite themes – that is “Chemicals Take Time”. You should read it but the headline says it all “After 14 years of R&D, P&G introduces Gemz, a first-of-its-kind, water-activated haircare solution”. My earlier blogs tell you what’s in there. Thing is – 14 years! They also interview the inventor. She says, among other things “Our jobs are innovative because we are focusing on new solutions for consumer problems, using the principles of chemistry, physics and biology, but applied to a consumer application,” Boom! 🚀 Nothing about toxic or indecipherable ingredients or harshness or all the rest of it. Just, you know, consumers and physics and chemistry. Gotta love it right?

Many companies talk sustainability. Many engage in lots of handwaving and the holding up of various talismans among which the 12 principles feature quite heavily. Some publish sustainability reports, some of which I find actually useful. I mentioned the company last year and I’ll do so again. Inolex’s sustainability report is worth a read. They are a small-ish company (161 employees) and the report is chock full of facts and data. They lay it all out there, water usage, GHG emissions, waste, recycling. Everything. But here’s one piece of information that I’ve never actually seen quantified before (Others may publish this but I just haven’t seen it). The company maintains 399+ product certifications annually. (Yep you read that right. Three Hundred and Ninety Nine!). That is wild. Hey - I bet you struggle to even name 10 off the top of your head (OK there’s ISO, Cosmos, Kosher, Halal, RSPO, Vegan, the bunny one and er the USDA one, erm.. the Nordic one – with the swan (is it a swan or a fox?), erm.. does China CSAR count? Cosmos! – no I said that..) see what I mean. That’s a lot certifications. I would love to see the list.

And 398 others…

And finally, Yes, I am definitely getting more curmudgeonly. Much of Linkedin is AI slop these days replete with humble brags and the aforementioned sanctimony. How refreshing therefore to see this post from Allied Carbon Solutions, a Japanese sophorolipid company addressing formulation issues with said bio surfactants. It says, in part “Handling Sophorolipids can be tricky! A common challenge is their inconsistent solubility:…. Another critical point for successful usage is managing the pH when diluting with water. … We recommend extra care when formulating at a dissolving pH of 5 or below.” Please check out the post and DM Makoto Hirota. I would love to see ACS rewarded with business for this clear and honest post.

Market News:

In detergent range alcohols, Asia's fatty alcohols market sees downward pressure on mid-cuts due to increased spot availability from new plant startups in Indonesia, with more capacity expected soon. Long chain prices are revised upwards by elevated Malaysian feedstock PKO costs, though some suppliers offer lower prices by using palm stearin. Demand is generally soft, further dampened by US-China trade tensions and macroeconomic uncertainties. In the US, Q4 contracts show mid-cut prices rising and long chains falling, as ample supplies meet weak demand amidst destocking, with a reduction in tariffs for Malaysian imports. Europe's spot prices for mid-cut fatty alcohols are stable to soft, with upstream PKO seeing a triple-digit decline, causing buyers to hesitate on Q1 commitments due to EUDR uncertainty and potential supply chain gaps. EUDR implementation dates are being clarified, with a grace period for larger companies.

The Asian fatty alcohol ethoxylates market remains subdued, with spot offers lower due to a prevailing slump in demand. Feedstock fatty alcohol mid-cuts and ethylene oxide prices are both declining, weighing heavily on FAE demand and spot interest. Buyers are holding back purchases in anticipation of further price drops amidst weak market conditions. Spot trades are slow ahead of the year-end holiday season and restricted to small, needs-based parcels. Market sentiment is further dampened by macroeconomic headwinds and renewed US-China trade tensions, which are disrupting global supply chains and increasing freight costs. Looking ahead, feedstock fatty alcohol mid-cuts are expected to continue falling, and poor consumer confidence will likely suppress demand.

The Asian linear alkylbenzene (LAB) market market remains in a slow demand phase, with buyers showing little appetite for spot material, even as regional supply tightens due to upcoming plant maintenance. A significant price gap persists between buyers and sellers, hindering trades in Southeast Asia. India's market is softening, with buyers anticipating lower offers for December, while the downstream LAB sulphonate (LAS) market also experiences dull demand. Looking ahead, supply across China and Asia is expected to remain snug in the near term due to ongoing maintenance, though plant expansions are anticipated to boost LAB capacity by the second quarter of next year. Upstream, benzene prices continue a downward trend, influenced by ample stocks and weak downstream demand, with market players expecting further weakness toward year-end.

Music Section

Not much for you this month as I’m trying to wrap up the blog before the weekend and I’ve not really been listening to much new or particularly notable honestly. So I opened up YouTube to see what the mighty algorithm had in mind for me. First it tried to get me to watch a Sabrina Salerno video from 1987. And I’m sorry to admit I did. And I am not a better person for it. Next up however, it delivered magnificently. Ten British heavy metal tracks that were released before Black Sabbath’s first album. I’ve constantly credited the Sabs for inventing and commercializing heavy metal. Now? Well the picture is more complex. Check these out (I put a few below – not all 10). If you only listen to one – the first one.

Futilists lament (brilliant song title) by High Tide. Bludgeon Riffola would apply.

Race with the devil by Gun (1969)

Of course, you may remember the faithful cover of the above, a number of years later by Judas Priest

Remember the Edgar Broughton Band? Here’s Love in the Rain (awful lyrics but decent riff)

Dream (never heard of these guys). Little Free Rock

Another one I’ve never heard. Rhubarb by Second Hand. Nice Riffage. Skip the first 30 seconds as it sounds like they were chucking someone out of the pub before they got started.

Too Old by Andromeda. More psych / prog but a pleasant enough outing

Well, that’s it. We don’t charge for the blog but if you are so motivated, visit our charity page (main menu up top) and support the Louverture School in Haiti.