Surfactants Monthy - December 2025

Surfactants Monthly – December 2025

It seems like I should do a “best of ’25” or like a blog wrap for the year or something. Erm.. I dunno. Maybe proclaim boldly that “2025 was the year of X in surfactants”. So – what was X? Hmm, well I have an idea which I’ll come back to. Then there’s “Our favorite blog stories of 2025” . OK I’ll give you that one. I think it was the lead story of the April blog. We talk about hero ingredients and then segue gracefully into some impressions from Unilever’s Supplier Conference in London. Check it out. The video’s pretty good also, even if I say so myself.

So coming back to the question: What is X in “2025 was the year of X in surfactants”? Answer: X = Renewable. I’m calling 2025 the year of Renewable in Surfactants. I realize this doesn't trip off the tongue… but…

Macroeconomics:

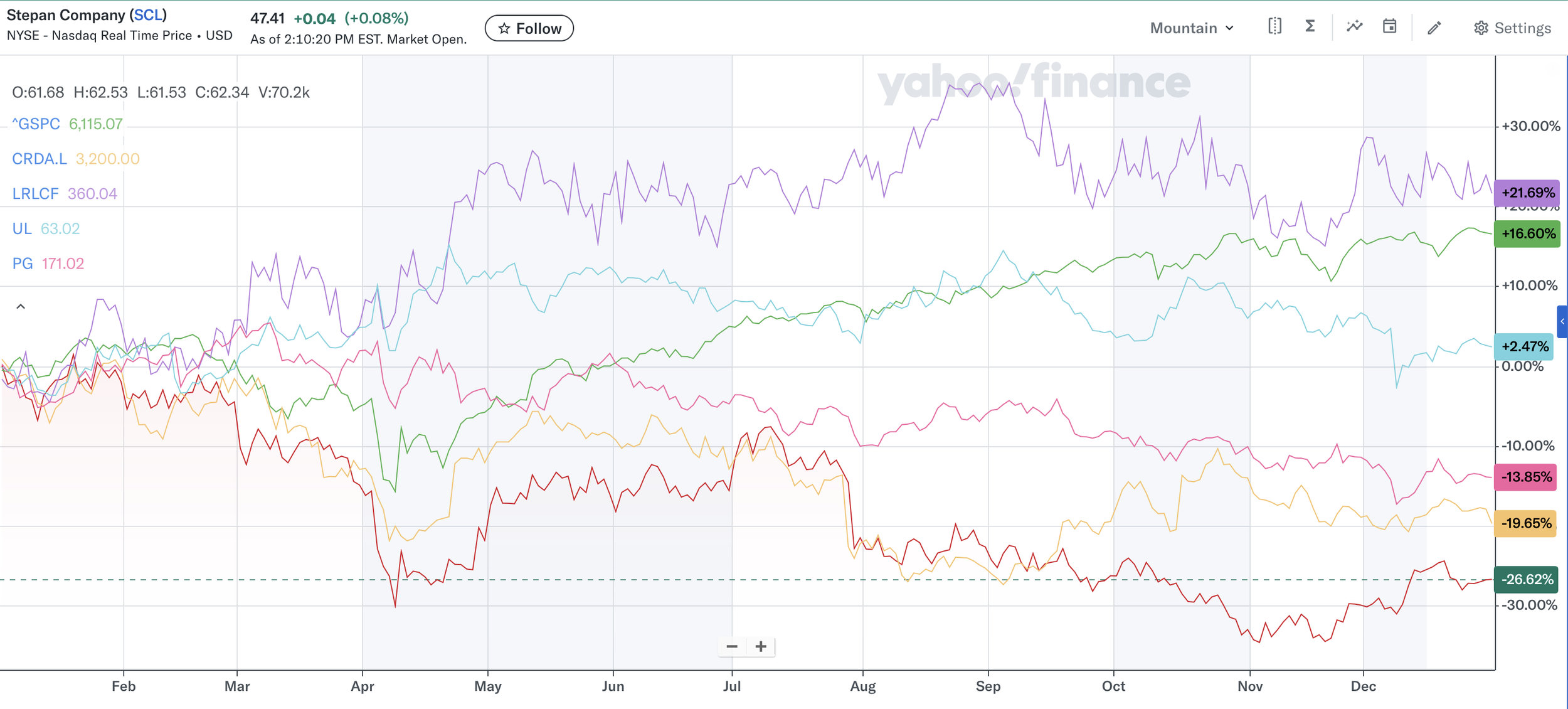

Not much this month. So for fun this New Year’s Eve (Yes. This is what passes for fun on NYE these days!) I put Stepan’s stock price on a chart, below, for 2025. They are in red and, as you can see, are down 26.47%. I added Croda, in gold, down 19.65%. Then P&G in a sorta dark pink, down 13.87%. Unilever, in light blue, up a mere 2.47%. The S&P500 in green, up 16.59% and L’Oreal, in purple, up 21.69% . What to make of it all? I need my intelligent readers to chime in here. (That’s all of you, BTW. You’re all intelligent!)

A rough ride in ‘25 for some

The News:

After last month’s discussion of Clean Cult here on the blog, one of our great readers reminded me that in 2017, Honest Company got sued for claiming SLS-free on a formulation that contained Sodium Coco-Sulfate. Apparently, behind the scenes, they blamed a supplier. Anyway, it was a class action suit and Honest represented SCS as a “coconut based cleanser” that is a “gentler alternative” to SLS, the The plaintiffs asserted that it is a scientific fact that SCS contains a significant amount of SLS. Honest Company, eh?

Pretty Privelege only gets you so far, thankfully.

Just after we went to press last month, Stepan announced that it had agreed to sell its manufacturing assets at Lake Providence, Louisiana. Stepan acquired the Lake Providence fermentation plant in 2021 as part of an effort to support its bio-surfactants business, a major part of which consisted of intellectual assets purchased from Logos Technologies (mainly rhamnolipids). The sale closed December 30th. The name of the buyer or financial details were not disclosed.

Earlier this month, Moeve (formerly CEPSA) and Honeywell announced an expanded collaboration to scale up production technologies of bio-based Linear Alkylbenzene (LAB). So what does this mean? According to the press release, Moeve’s technology to produce NextLab-R, the first LAB produced at industrial scale using renewable raw materials, will be made available to the market through Honeywell’s licensing platform, providing detergent manufacturers with a more sustainable raw material solution. The expanded agreement also adds joint process development and renewable LAB to Honeywell UOP’s licensing portfolio. Here’s a little more interesting background: Honeywell pioneered LAB process licensing in the 1960s. Today, more than 70% of global biodegradable detergent production relies on LAB made using Honeywell UOP process technologies.

It's been telegraphed for some time, but BASF announced late November the expansion of its Alkyl Polyglucosides (APGs) footprint in Asia with a new plant at the Bangpakong site in Thailand. BASF currently produces APGs at sites in Düsseldorf, Germany; Cincinnati, Ohio; and Jinshan, China. The expansion in Bangpakong strengthens regional supply capabilities in Asia, while a new APG production line in Cincinnati, scheduled for completion in 2026, will further enhance capacity in North America. No actual data on the capacities. My guess (and it is just a guess. I have no inside or other type of knowledge) is that we are talking 25 KMT/yr in Thailand and 25 KMT/yr expansion in Cincinnati. BASF’ers (Actually, I guess it’s Aniliners) - the ever popular tipline is open.

You know what to do…

I read in HAPPI that, avid blog reader and surfactant conference speaker, Marcelo Lu is moving from BASF to Clariant where he will be President Designate for Care Chemicals & Americas, Clariant’s largest business unit with approximately 4,000 employees. In his role, he will be a member of the Executive Steering Committee. For the first six months, Lu will be based at Clariant’s global headquarters in Switzerland, where he will contribute to group-level priorities and collaborate closely with senior leaders across the organization. Marcelo was most recently based in Singapore.

Congrats Marcelo!

It’s been in the works for a while and now: LIVINEX IO 7 is a nonionic surfactant derived from Black Soldier Fly Larvae (BSFL) oil, engineered by Sasol International Chemicals as a drop-in replacement for conventional C12–C14 oleochemicals in fabric, home, and institutional cleaning applications. Rich in mid-chain fatty acids chemically identical to those in palm kernel and coconut oils, the product utilizes existing ethoxylation infrastructure to deliver performance parity in viscosity, stability, and surface activity without requiring formulation changes. Produced via vertical farming methods that avoid land-use competition, this bio-circular, deforestation-free ingredient is launching in Europe to meet EUDR requirements while offering a straightforward product carbon footprint calculation. Interesting. Will it catch on? What do you think..

Unilever’s Dove has launched a collaboration with the Netflix series Bridgerton. Ingredients? The surfactant platform for the soap, body wash and body scrub is built around isethionates and taurates. No surprises there.

And EO at the heart of it

Huge news from the world of process tecnnolgy. Ballestra has agreed to be acquired by NextChem (Maire) an Italian engineering company with many complementary capabilities. Here is most of the press release:

Founded in 1960 and headquartered in Milan, Ballestra S.p.A. is the holding of a group of companies comprising BUSS ChemTech AG (Switzerland) and Ballestra Engineering and Projects Pvt. Ltd (India). Ballestra Group operates in over 120 countries with approximately 450 employees and offices in Europe and Asia, serving a well-established base of blue-chip clients supported by a proven track record of over 6,400 plants installed worldwide. It relies on a strong intellectual property and R&D expertise, continuously sustained by proprietary pilot plants in Italy and Switzerland, which serve as innovation hubs for testing and scaling new technological processes.

Ballestra has a long-standing heritage in detergents, surfactants and oleochemicals serving chemical producers as well as leading FMCG (Fast-Moving Consumer Goods) companies through licensing, engineering services and proprietary equipment – sold through the well-known Mazzoni brand and assembled in the Company’s own facilities in Busto Arsizio (Italy).

Additionally, Ballestra’s chemicals division specializes in advanced processes for producing sulfuric and phosphoric acids, key components in the manufacturing of phosphate-based solutions, NPK (Nitrogen, Phosphorus and Potassium) nutrients and specialty fertilizers. The integration of Ballestra’s phosphate-sulphur and potassium-based fertilizer technologies expands NEXTCHEM’s technological portfolio and complements its market proposition in nitrogen-based fertilizers.

BUSS ChemTech, Ballestra’s Swiss subsidiary acquired in 2021, is a world leader in fluorine derivatives and gas-liquid reaction processing plants. In particular, among the fluorine derivatives, the hexafluorophosphate is essential for solar cell production, lithium-ion batteries, and specialty gases for power grid upgrades and the fast-growing demand for electrification. It is also active in pyrolysis technologies for hard-to-recycle plastic waste, supporting the circular economy and decarbonization efforts of the industry.

The acquisition of Ballestra Group brings a robust portfolio of proprietary technologies that further expand NEXTCHEM’s value proposition in the chemical and fertilizer sectors adding in its portfolio new adjacent products entirely covering the potassium, nitrogen, sulphur and phosphate segments and supporting electrification, recycling, emissions reduction and energy efficiency, while creating cross-selling opportunities with MAIRE’s IE&CS division, leveraging Ballestra Group’s strong track record.

Ballestra’s consolidated backlog, standing at €275 million at the end of September 2025, was further reinforced in the fourth quarter, and is expected to exceed €315 million by year-end. FY 2025 Group revenues are projected at approximately €235 million.

The agreement establishes an enterprise value of €108.3 million. Based on Ballestra’s consolidated net cash position of €18.2 million as of 31 December 2024 as adjusted according to the criteria agreed in the contract, the resulting purchase price is approximately €126.5 million. The final consideration, entirely payable at closing, will be calculated on the basis of the updated net financial position adjusted according to the same criteria contained in the contract. The acquisition will be funded through a combination of cash-on-hand and credit facilities granted to NEXTCHEM.

The transaction is expected to be finalized in the first half of 2026, pending customary closing conditions.

Nextchem has capalities in Ammonia, Carbon Capture, Circularity, Hydrogen, Methanol, Nitrates, Polymers, Power, SAF, Speciality Chemicals, Sulphur, Urea and other areas.

Welcome to surfactants guys!

Some good stuff (among all the AI slop) on Linkedin these days. Ashely Quigley of Surfachem published a very useful guide to stability testing for HI&I detergent formulations. Check it out here

Croda recently opened its new site in Dahej, India, for ethoxylation (I’m pretty sure) and likely also propoxylation. In addition they tout:

• Carbon-neutral operations (Scope 1 & 2) powered entirely by green energy

• Zero Liquid Discharge, enabling full water recycling

• Advanced alkoxylation and pastillation technologies for high-performance, reliable supply

• A SIL 3-rated control room, smart IMCC, and FTNIR/GC–MS lab to ensure safety, quality and compliance

• Global certifications including QMS, EMS, OHSAS, GMP, SMETA and EXCiPACT-compliant packing

I wish Croda much success

And finally, there was a rather interesting discussion got going on Linkedin around Fairy Liquid hand dishwash and its ingredients. You can read it here. I am still working on getting one or more of the protagonists to participate in a video. In the meantime, here are some key view points summarized for me by Google Gemini 3 Pro (Review Version)

Original Post Summary:

Tessa Clarke (Co-founder & CEO of Olio) posted an image of a Fairy washing-up liquid bottle, contrasting a picture of a baby on the front with hazard warnings on the back (serious eye irritation, harmful to aquatic life). She questioned why cleaning products still rely on hazardous ingredients in 2025 and asked folks to explain why "clean plates come with environmental hazard warnings."

Summary of Comments & Key Viewpoints

1. Industry & Technical Rebuttals (Chemists, Toxicologists, Formulators)

Concentration vs. Dilution: Experts explained that hazard labels apply to the product in its concentrated form. Once diluted in a sink of water (the intended use), the hazard is negligible.

Surfactant Functionality: To effectively remove grease and fat from dishes, products must contain surfactants. Because human cell membranes are lipid-based, any agent effective at stripping grease will inherently irritate eyes or skin if exposed to the concentrated liquid.

Regulatory Requirements: The labels (GHS/CLP) are legal requirements for worker safety (those handling large quantities) and consumer transparency. Experts noted that "irritant" is distinct from "toxic."

Preservatives: Experts noted that preservatives (specifically Methylisothiazolinone) are necessary to prevent bacteria and mold growth in the bottle, though they can be allergens.

2. Ingredients & "Natural" Alternatives

Chemical Reality: Chemists noted that "natural" alternatives often carry similar risks. For example, vinegar is acidic and natural soaps are alkaline; both can cause eye irritation or aquatic harm depending on concentration.

Specific Compounds: Discussion highlighted that ingredients like Sodium Lauryl Sulfate (SLS) are standard for efficacy. Critics of the post noted that even "eco" brands often carry similar irritation warnings because they use similar surfactant chemistry.

3. Validity of the Image

AI Generation: Multiple users identified the image in the post as AI-generated (noting typos like "Proctor and Gomble" and the aggressive expression of the baby). Tessa Clarke confirmed she used AI to combine images.

Marketing Criticism: While admitting the image was fake, Clarke and supporters argued the underlying point remains: branding often uses soft, safe imagery (babies, nature) to mask the hazardous nature of the chemicals inside.

4. Environmental & Health Concerns

Aquatic Toxicity: Several commenters expressed valid concern regarding the "harmful to aquatic life with long-lasting effects" warning, questioning the impact on water systems despite dilution.

User Experience: Some users reported skin rashes and irritation from standard brands, advocating for bio-based alternatives, solid dish bars, or DIY solutions (e.g., ivy leaves, vinegar/baking soda).

Now as I read the above it all sounds dry. The discussion wasn't dry (although some of the humour may have been). More to come, hopefully. In the meantime, there’s this…

Market News:

Asian fatty alcohol ethoxylates (FAE) prices are falling due to a slump in demand, weak market sentiment, and declining feedstock costs, leading buyers to postpone purchases. Spot trades are minimal ahead of year-end holidays, with planned plant maintenance expected to tighten supply soon. In the US, Q1 contract negotiations are underway amidst ample supply, weak demand, and tariffs that continue to pressure margins and discourage imports. European mid-cut fatty alcohol spot prices are stable to soft, influenced by falling upstream PKO costs and uncertainty around EUDR implementation, while Q1 contract discussions are impacted by weaker feedstock prices and concerns over future supply. The EU has also introduced a trade deal with Indonesia that will eliminate tariffs on many exports.

The Asian linear alkyl benzene (LAB) market remains stable with suppliers holding offers firm despite dull buying interest due to year-end holidays. Spot supply in Northeast Asia is snug due to maintenance, while Southeast Asia sees weak demand. India's LAB market is firmer amid ongoing spot supply concerns and upcoming domestic offers. The downstream LAB sulphonate (LAS) sector in Asia is supported by an elevated sulphur market, with suppliers pushing for higher values despite slow demand. Near-term LAB supply across China and Asia is expected to remain tight due to maintenance, though new capacity could provide future relief. Benzene prices in Asia are trending lower due to ample availability and weak downstream demand, while firm sulphur prices face buyer resistance.

Asia's fatty alcohol ethoxylates market is subdued, with spot prices falling across all chain lengths due to a persistent slump in demand and declining feedstock costs, particularly for mid-cuts. Buyers are largely staying on the sidelines, anticipating further price reductions and holding back on restocking as the year-end holiday lull limits market activity. Supply remains ample, further pressuring prices. The market outlook is uncertain, with players awaiting clearer direction for the new year amidst prevailing weak demand, macroeconomic headwinds, and geopolitical tensions.

Last Section (apart from the music which is always right at the end):

So, I still feel like we need a year end section or something seasonal and special.

So – on Christmas day, someone sent me a poem. Someone in our industry. I won’t name them. They (and maybe some of you) know who they are. I was quite inspired and touched by it. I thought – how come we don't send each other poems any more? Maybe you do. I haven’t sent a poem to anyone since, well it was a while ago and I was young and somewhat idealistic; unrealistically so. Then on New Year’s (today as I write this), I got a Winnie the Pooh video sent to me. It looked like the original drawings, animated, with a very good message voiced over. Again, I won’t name the sender but it was someone else in our industry. I watched it first thing and now it’s got me in this mood. It’s a good mood. I gotta write a poem right? And I have to put it here. It should probably be something industry related, if possible. And - you see I’ve boxed myself into a corner - it has to rhyme. After years of railing at anyone who’d listen that proper poems rhyme, this one better. Feel free to stop reading here and skip to the music section (some favorite songs from the year).

OK so here we go. Also I’m promising not to use AI or a rhyming dictionary as that would be cheating wouldn't it?

A Proper Poem

A bridge too far, the ancient saying goes

Can’t bring two warring armies to unite.

The gap’s too great between th’implacable foes.

Their instinct goes to fight if not to flight.

The man recoils from that which is not man

The woman too. She’s not immune from this.

So, first dehumanize them if you can,

The better to drag all into th’abyss.

Is there a better way to bridge this gap?

A way in which destruction does not rule?

The brutal tribal logic of the map

Yields the dull comprehension of the fool.

The fear and love which fuel man’s greatest fires

Are forces which we must learn to control.

Love conquers all, when chasing our desires.

Fear too will win when it o’erwhelms the soul

Thus love and fear, we must therefore conjoin

Like heart and head working in harmony.

An equal side of each fair human coin

For life more sweet than the most pure honey.

Phobos and Filios th’ancient Greeks did once say

To surface science, lending lingual sense.

Hydrophobe, hydrophile - amphipile, yay!

Two natures working to bring value hence.

Gears melt, engines halt without amphiphile.

Disease and dirt spread when one can not clean.

Fields bear small fruit though we plant all the while.

Surfactants bring life. Society’s seen.

To bring unlike things together, that’s how

Surfactants work in today’s modern world.

Can you be a social surfactant now?

Bridging gaps! Let the banner be unfurled!*

Join love to fear. It’s harder than it sounds

Trying out there puts you at risk of harm

But human capacities know no bounds

Life imitates chemistry and brings calm

*Full disclosure: I borrowed this forced rhyme from the great Neil Peart who used it in 2112.

Alright there it is. If you seek to blackmail or embarrass me by quoting this, I’ll write mean things about you in the blog. Now, that’s not very loving is it? OK. I’ll forgive you, then write mean things about you.

Music Section

Some songs, I always seemed to go back to this year. Mostly repeats from various points in the blog’s past.

Judas Priest – Sinner. Lyrics are so perfectly fitted to Rob Halfords range.

Judas Priest – Genocide Live. Has to be one of the heaviest riffs ever, no?

Rush – Cygnus X-1 Book 2 – because, you know, Rush.

Rainbow – 16th Century Greensleeves – Actually also one of the heaviest riffs ever

I used to really like these guys – Lone Star from Wales