Surfactants Monthly - October 2025

On our YouTube channel we just complete part four of “How to Succeed in Surfactants” which focuses on SG&A costs. Check it out here and let me know your thoughts:

Macroeconomics:

The Fall 2025 Grace Matthews (an I-Bank) newsletter is out here. Some key points.

· M&A Activity Rebounding After a Slow Start: M&A activity for North American chemicals and materials companies declined by over 40% year-over-year in the first half of 2025. This slowdown was primarily caused by uncertainty surrounding global trade and tariffs, which led many potential sellers to delay their plans. However, transaction volumes saw a sequential improvement in the third quarter, and the outlook is optimistic for a more robust market heading into 2026

· Buyers Remain Well-Capitalized and Eager: Despite a drop in the supply of businesses for sale, potential buyers, including both corporate acquirers and private equity firms, are well-capitalized and actively looking to deploy funds. Strategic buyers are focusing on smaller, synergistic "bolt-on" deals, and their balance sheets remain strong.

· Pressure on Private Equity to Sell: The average holding period for U.S. private equity-backed companies has reached its longest duration in at least ten years, climbing to 3.8 years as of June 2025. This creates increasing pressure on private equity firms to sell their investments to return capital to investors, which is expected to drive more companies to market.

· New Trends Driving Demand: The rapid growth of the artificial intelligence (AI) industry is creating a significant new source of demand for a wide array of chemicals and materials. The extensive construction of infrastructure like data centers requires building products, water treatment chemicals, metal treatment chemicals, and fire suppression systems, among others.

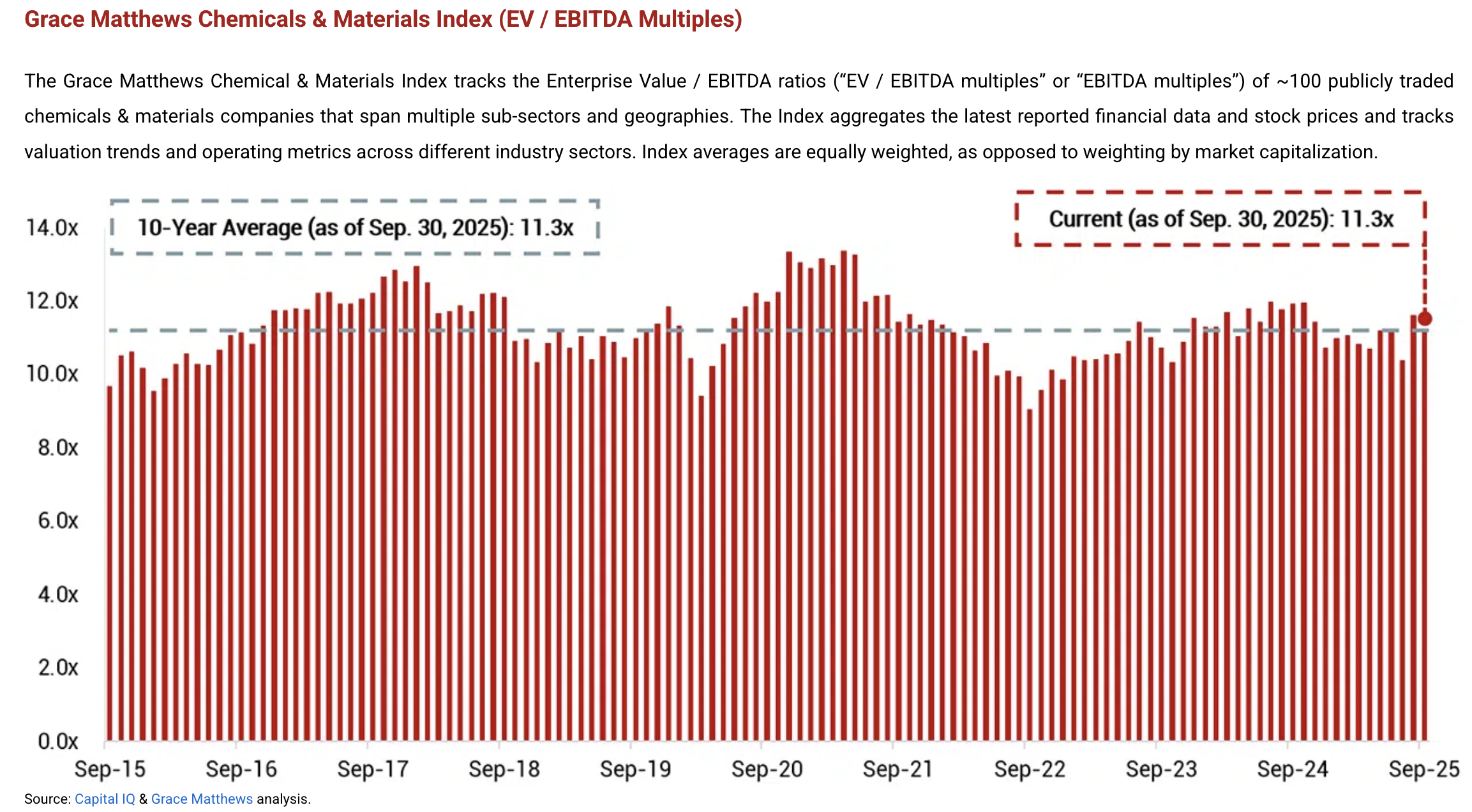

· Valuations Remain Stable: As of September 30, 2025, the Enterprise Value to EBITDA multiples for publicly traded chemical and materials companies were at 11.3x, which is identical to the 10-year average. This indicates that underlying valuations in the sector have remained stable despite the fluctuation in deal volume.

Chemicals at normal multiples - Unlike a lot of other things.

The News:

I’m going to try to rank order the news in terms of impact on the industry. Let’s see how that works.

In October 28th, WSJ, an article caught my attention entitled “The Lengths Americans Are Willing to Go to Make Every Penny Count” with a sub-head “From buying half a cow to watering down soap, people are experimenting with frugality—and it is affecting sales at consumer companies” Here it is but it’s beind a paywall. So, I’ll summarise (un-AI-aided, I might add). It’s a canary in the coalmine type article about what consumers are doing in response to rising prices and concerns about their financial status. Some are shopping at less expensive shop, so Aldi vs Wegmans (good move in my opinion). More telling though, P&G reported volume declined 2% in the latest quarter in its home and fabric-care division, which includes Tide, Dawn and Swiffer. Meantime, private-label brands that make cheaper generics haven’t seen a corresponding increase, the company said last week, suggesting consumers are using up their inventory and making their existing stock last longer, rather than trading down. At least so far. Here’s the bit that got me; Julie Simpson (a consumer) is diluting, with water, her Dawn dish detergent and Clorox floor cleaner. Some of this has first-world problem vibes about it though. One consumer has apparently had to pause her dog Zane’s monthly toy subscription. Oh no!

So, is this the end of the world? No but it may be the end of the bull market economy. Consumers trade down during recessions and although the article claims this not happening, to me, dilution is very much trading down. It will be interesting to see how all this shows up in results of the larger commodity surfactants suppliers to North America.

Speaking of which – Stepan announced Q3 25 results on October 29th and they were pretty bad, with most of the badness confined to surfactants and very much in line with what we have just read. Key points:

· Total Net income down 54% vs Q3 last year, to $%10.8 Million.

· On a nine-month YTD basis, sales $ were up 7% and Adjsuted net income down 12%

· Getting now into the Surfactants business (about three quarters of company revenue):

· Surfactant sales were up 10% on a 9 month and 3 month basis vs last year, but this was essentially price driven due to soaring oleo raw material costs.

· Surfactant operating income was off 40% for the quarter and 16% vs last year for the 9 months.

· The company noted that surfactant sales volume declined 2% year-over-year primarily due to lower demand within the commodity Laundry and Cleaning end markets that was largely offset by double digit growth within the Agricultural and Industrial Cleaning end markets. Foreign currency translation positively impacted net sales by 1%. Surfactant adjusted EBITDA(2) for the quarter decreased $6.2 million, or 14%, versus the prior year. This decrease was primarily due to higher expenses associated with the start-up of the new alkoxylation facility in Pasadena, Texas, a 2% decrease in sales volume and higher oleochemicals raw material costs.

· Also they have a new CFO.

Here's the box-score.

Shaping up to be a tough year.

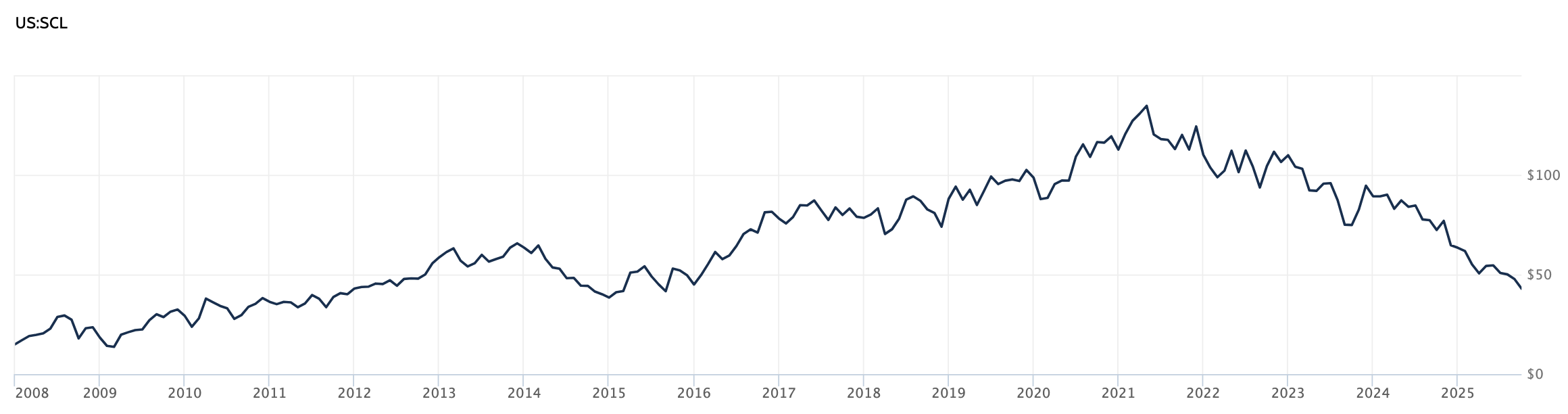

And here’s look at the Stepan (SCL) stock price. As you can see, they had a great run coming out of the 2008/09 financial crisis and a good COVID bump. Since then though, a rough ride down to levels not seen since 2015.

An unkind market?

Meanwhile Unilever seems to be doing just fine. As reported in Cosmetics Business; Unilever’s ‘power brands’, including Dove, Rexona and Sunsilk, drove sales growth during the quarter. Sales increased by 3.9% and turnover reached €14.7bn, which was driven by the consumer giant’s Beauty & Wellbeing and Personal Care divisions. Beauty & Wellbeing sales increased by 5.1% and Personal Care grew by 3.1% driven by demand for Vaseline, Liquid I.V., Nutrafol, Hourglass and K18. Unilever’s ‘power brands’, including Dove, Rexona and Sunsilk, also drove sales growth and contributed 78% of turnover for the quarter. “We continued to outperform in developed markets in the third quarter, led by our strong innovation programme, and, following decisive interventions, stepped up our emerging markets performance with a return to growth in Indonesia and China,” said Unilever CEO Fernando Fernandez.

Unilever’s Hair Care division growth was flat, with performance varying across brands. Dove’s hair care offering grew double-digit and that was supported by the successful roll out of its new fibre repair technology range. Hair care brand Tresemme, meanwhile, grew low single-digit figures as increased momentum in styling and treatment ranges helped to offset volume decline in the US. Unilever’s Skin Care business benefited from double-digit growth from Vaseline, thanks to demand for its new Cloud Soft Light Moisturiser in India. Unilever’s Prestige Beauty segment also grew mid-single digit, with brands including cosmetics business Hourglass and hair care brand K18 reporting growth. Paula’s Choice and Dermalogica also returned to growth after declining in the first half of the year.

Plenty to celebrate at Unilever

There are some major developments in Indonesia, as outlined in this Reuters article, which is worth a read in full. The headline reads “Fear grips Indonesian palm oil industry as military seizes plantations” and it’s not a small matter. Apparently around 3.7 Million hectares of plantations (22% of Indonesian total acreage) have been seized by the Indonesian government (with the aid of the military) and nearly half of that transferred to a new state owned firm, Agrinas Palmas Nusantara. According to Reuters, that puts this new firm into a postion as the largest palm oil company in the world by land size. Needless to say there is consternation all round. The justification for the seizures revolves around illegal operations on forest land and corruption. However it looks like many big names are under the microscope by the government including Wilmar, SD Guthrie, Sinar Mas, Musim Mas and others. In an already tight market for palm oil (and palm kernel oil). , there is concern that yields will drop in the face of these nationalization efforts.

Further on this story, The Edge, Malaysia reported that the new company seeking to set up joint operations to manage its plantations. Sutomo, the head of the firm noted, "Everyday our output of fresh fruit bunches varied between 5,000 and 6,000 metric tons per day. In the near future we will invite partners to help us, and output is expected at 10,000-12,000 tons," Sutomo said. Agrinas is aiming to produce 415,000 tons of crude palm oil in 2025 and more than double its production to 1.07 million tons next year. Of the 1.5 million hectares of plantations managed by the company, 509,644 hectares have been planted and 323,748 hectares not planted, with the rest still going through a verification process, he added.

So, clearly this situation merits further close study in terms of its potential impact on our surfactant supply chain. We’ll get int it all in a lot of detail next month in Kuala Lumpur, to be sure. Last chance for tickets here : https://events.icis.com/website/14105/home/

This looks pretty serious. I’m keen to get other perspectives.

Extended Surfactants. Another example of the greatness of our readers: After writing about these in the August blog, a regular reader wrote in to note that he learned about these from a lecture by J.L. Salager and they found particular use in oil solubilization. He sent me a presentation from the 8th CESIO, Vienna 2011 (I remember it very well) . I won’t embed the paper here but it looks like Salager is still at FIRP and his details are here https://firp-ula.org/members-duplicate-97/ . In summary the paper tells us that extended surfactants are molecules designed to improve solubilization, particularly of polar oils. They feature a spacer of intermediate polarity, such as polypropylene oxide (PO), inserted between the traditional hydrophilic head and lipophilic tail. This intramolecular mixture creates a more gradual transition between oil and water phases, increasing interactions and enhancing solubilization. The properties and effectiveness of these surfactants can be adjusted by altering the length of the PO spacer to match the oil being solubilized. Applications include detergents, cosmetics, enhanced oil recovery, and injectable microemulsions. Interesting right?

And from another great reader, I got a bit of pushback about my praise of the “No Palm Ingredients” company name. While ceding it was as clear and simple name, he didn't like the demonizing of palm and thought it might alienate many customers who will essentially never sever their palm relationship. And you know what, he’s right! More on the demonization of palm later in the blog.

Not specifically surfactants related but indicative of the woes besetting chemicals in Europe and affecting surfactants as well as many other ares. Ineos put out a press release noting that they will shut two production units in Rheinberg, Germany, with the loss of 175 jobs. The proposed closures are the direct result of crippling energy and carbon costs, and a lack of tariff protection. Both plants produce essential chemicals. The Allylics unit makes the key ingredient for epoxy resins vital in defence, aerospace, cars and renewable energy infrastructure. The electro chemical facility produces chlorine crucial for clean water, medicines, industrial processes and sanitation. These closures are part of a wider trend as Europe’s competitiveness collapses. Since

2019, output in Germany has dropped by 18%, driving job losses and reduced

investment. INEOS has closed plants in Grangemouth (UK), Geel (Belgium). It is closing Gladbeck (Germany), and has mothballed assets in Tavaux (France) and Martorell (Spain). Sad.

I got a press release from company with the delightful name of New Wave Biotech, who claim to have an AI driven (aren’t they all) method to improve lipid extraction. Here’s the site https://www.newwavebiotech.com/. I’ve no means to judge but maybe there’s something here to help biosurfactant companies and the like, up their yields. There’s this graph on their site which I think captures the problem. The solution though? Well, let’s see. Keen to hear from folks that have worked with them. Tipline is open.

Lotta waste right?

IFF sent me something on “natural betaine”. Here’s more information. Turns out though it’s not the sort of betaine you and I are familiar with. So - natural betaine, chemically known as trimethylglycine, is a small amino acid derivative found in plants like sugar beets, as well as in the human body. As detailed by IFF, it is sourced as a natural, upcycled byproduct of sugar production. Its primary function in personal care is as a moisturizer and osmolyte, a molecule that helps cells manage water balance and protect against dehydration. Cocamidopropyl betaine (CAPB) is fundamentally different. It’s a surfactant whose name includes "betaine," but it possesses a much larger and more complex structure with a long fatty acid tail. It is used in cleansers of various types (and still often in dishwash) to support mildness. So now you know.

I’m getting some interesting news out of China. In August Shanghai Fine Chemical Co., Ltd., a subsidiary of Sinolight Surfactants Technology Co.,Ltd. publicized their “Tall Oil-based Imidazoline Surfactant". They have a plant for it with 3,000 MT/ yr capacity. I couldn't find much else online. Anyone have anything to add?

The Biomass Balance express train keeps..er.. rolling with the recent announcement that BASF has delivered its first shipment of biomass- balanced BMBCert 3 (dimethylamino)propylamine (DMAPA) in Asia Pacific to Galaxy Surfactants Ltd., who plans to use the BMBCert DMAPA to produce Galaxy CAPB SB for personal care. Cool. Here’s more: BASF produces ISCC PLUS and REDcert2-certified BMBCert DMAPA at its production sites in Ludwigshafen, Germany; and Geismar, Louisiana, the United States.\ BASF reduces the cradle-to-gate product carbon footprint (PCF) by replacing fossil feedstock with certified renewable resources at the beginning of the value chain. A corresponding amount of renewable content is attributed to the product according to a mass balance approach. In addition, BASF uses renewable electricity in the manufacturing of BMBCert DMAPA, further reducing its PCF.

Now, I like BMB. It’s a good option. But I find there are some that think it’s somehow “cheating” and that its growing use is a bad thing. I don't get that. You’re still replacing fossil inputs with biogenic carbon inputs and so, if you don’t like fossil then that should be good, right? I’ve concluded that the folks making this BMB is bad argument are doing so from the point of view that the companies (often big petrochemical ones) that practice it are inherently bad. And that anything that helps these companies in any way can’t be good. Could this be it? What’s another good reason to be against BMB (note : not just preferring not to use it themselves but being actively against its use in general)?

I like water-free also. It’s an innovative field with some big and small companies involved – up to an including P&G. Their product line Gemz recently announced a recycling partnership with Terracycle. Here’s how it works [for Free!]: Consumers can send in their empty Gemz shampoo and conditioner capsules and packaging for recycling through TerraCycle. Visit www.terracycle.com/gemz, sign up, and download a prepaid shipping label. Place the empty packaging in any box you have on hand, affix the label, and ship it to TerraCycle. Once received, the collected materials are recycled into pellets that can be used to make new products such as outdoor furniture, storage containers, and playground equipment.

We’ve written a bit about Croda here at the blog. Mid month the company reported a continued challenging trading environment for the rest of the year as U.S. tariffs were hurting exports of its pharmaceutical and agricultural customers in some regions. The company, pointed to low visibility [I like that phrase don't you?] in its order book as levies by the U.S. government add to the volatility in its markets. However, Croda reaffirmed its outlook for 2025 on a boost from cost cuts, as the company posted a 6.5% rise in third-quarter sales at constant currency rates, helped by steadier demand in the beauty and crop‑sciences sectors. The company also forecast fourth-quarter sales to be seasonally lower than the first three quarters, citing reduced customer spending towards the end of the year. Hmm – gels with our first piece up top about consumer thriftiness right?

In Chemistry World, a publication of the RSC, an article warned against using AI to draw chemical structures. It turns out they get them horribly wrong, a lot. This includes something as simple as benzene. So, I guess forget about LAS or any lauric derivatives let alone betaines and such. So - we know the LLMs are crummy at Math and now chemical structures. Yet at the same time, I hear how AI is going invent so many great new chemicals, materials and drugs to cure cancer and whatnot. Hype? Of course. Where’s there are unicorns there’s hype. Beware.

Not as easy as it looks

My attention was drawn to this Ocean Saver product recently on Linkedin by one of my favorite acerbic commenters with a solid surfactants background. Needless to say he was not impressed by the hyperbole and claims.

Anyway I like to take a look at the ingredients in these heavily hyped consumer products and in their dishwash tablets they merely list “>15% - < 30% Oxygen-based bleaching agents, < 5% Nonionic surfactants, Enzymes, Perfumes” Hmm OK – maybe better luck with the laundry sheets. Here they list “Contains amongst other ingredients: An-ionic surfactant ≥35%, non-ionic surfactant ≥15%, Polyvinyl Alcohol, Betaine, Sodium Citrate, Perfume, Sodium Acetate Trihydrate, Silicone Oil, Hexylcinnamaldehyde, Citral.” You really get a lot more comprehensive ingredient disclosure from P&G and Unilever and they’re not even claiming to save the Oceans. I think if you are making big claims your disclosures have to be also big (and impressive). Don't assume just because you’re small and preach sustainability, you’re ahead of the big guys. Honestly, you’re probably not.

More news from Future Origins. The company announced the successful completion of a large-scale demonstration campaign of Nalo™, its drop-in replacement for C12/C14 fatty alcohols. The campaign produced more than 10 tons of alcohol. The purified product from this large-scale production will be shipped to current and prospective partners for testing across multiple applications in the home and personal care segments. The company says Nalo will be manufactured at industrial scale in the coming years. Kao recently secured an offtake agreement covering a majority of the planned capacity of Future Origins’ first manufacturing plant. Future Origins was leader Genomatica (“Geno”), together with Unilever, Kao, and L'Oréal, to commercialize and manufacture high-volume sustainable ingredients for widely used surfactants used in the global home and personal care markets. Galaxy Surfactants Limited has provided independent product quality and formulation testing for Future Origins throughout the successful technology scale-up program. [OK now – readers will recall that this technology, using E. Choli fermentation, originally got its commercial start with a company called LS9 that was then sold to REG and then on to Geno. In 2009 LS9 announced a partnership with P&G and in 2012 announced the successful demonstration production ( at a plant in FL) of several tons of fatty alcohol, one of which it sold to P&G. So does mean that it takes 13 years to get from “several” to 10 tons? Probably not a fair perspective, but it nonetheless underscores the point that chemicals takes time and money. Especially new chemicals and new technology. Anyway, I am rooting for Future Origins. I wanna see this finally work – at scale – at cost.

They take time…

Biorenuva sent me some info on the use of their rhamnolipid as a fragrance solubilizer. You can download it here. It touts superior blooming vs using ethoxylated castor oil on a test fragrance rejoicing under the appellation Luzi-Party All Night, which if you are going to do, well, you’re gonna need plenty of bloom, I guess, right? Anyway, the company posits a physico-chemical reason for the superiority of their product as follows. Keen to hear opinions on this reasoning. Looks interesting.

I know many of our readers are involved in polymers as well as surfactants. Heres a link to an interesting open access article, by authors from L’Oreal covering polymer design for applications including silicone replacement. Some key points from the paper.

· Replacing petrochemical polymers is challenging because their specific molecular structures deliver high performance. For example, the high charge density of synthetic cationic polymers like polyquaternium-10 allows for effective film deposition on hair, a function that natural alternatives like chitosan struggle to match due to their lower charge density and different interaction with surfactants.

· Silicones, particularly MQ resins and elastomers, are critical for long-lasting, water-resistant makeup and for providing a unique powdery feel as fillers. While effective and non-ecotoxic, their key sustainability issue is a lack of biodegradability. Attempts to replace them with hydrocarbon-based acrylate polymers have managed to replicate performance but face the same end-of-life challenge of non-biodegradability.

· Even promising sustainable alternatives have significant hurdles. Cationic guars, while bio-based, require a "quaternization" chemical process that uses toxic reagents and is not environmentally friendly. Chemical modifications needed to make natural polysaccharides high-performing often eliminate their inherent biodegradability.

Indian readers, can you tell me how significant this is (if at all). I read that On October 22, 2025, India's Department of Chemicals and Petrochemicals announced to abolish the Quality Control Orders (QCOs) for 6 chemicals with immediate effect. This decision rescinds the notification relating to QCOs for the following 6 chemicals issued in 2022, including lauric acid, palm fatty acids and coconut fatty acids.

We like Acies Bio here and they spoke last year at the WSC. I was pleased to read in World Bio Markets that the company started constructing a new facility with advanced fermentation and downstream processing (DSP) capabilities. The project features a 30 m³ bioreactor, the largest in the company’s history. This expansion marks a significant step toward increasing large-scale biomanufacturing capacity from the current 10 m³ size. The new infrastructure is expected to be completed by Q4 2026

The new facility with a 30 m³ bioreactor doubles their fermentation capacity to 72 m³.

EUDR (you know what that stands for) has been delayed but problems persist as highlighted by a letter from APAG and many other interested trade groups. Read it here.

Key Points:

· The signatories argue that recent last-minute changes to the EU Deforestation Regulation (EUDR) have created significant legal and operational uncertainty, with an unrealistic implementation timeline of 30 December 2025.

· They highlight that the staggered compliance dates for different-sized companies are impractical, as the interdependence of supply chains will force small and micro-enterprises to comply at the same time as larger ones.

· The group urges the European Commission to implement a "stop-the-clock" mechanism to allow for a thorough reassessment of the regulation, aiming to create a more workable and clear framework while still supporting the environmental goal of combating deforestation.

I wish them luck in reasoning with the Leviathan.

Tought to reason with

This may only affect a few readers, but I read in ICIS that Fitch Ratings warned that SI Group will likely default within 12 months and lowered the chemical company's ratings to CC, a level two notches above default. They’re running out of money and are expected to be out by the end of next year. Sales fell by 13% during the first half of the year, and Fitch-defined EBITDA dropped by 30%. Sales volumes are struggling because of weak demand, destocking from 2023 and new capacity in China.

"With oversupply and no meaningful demand recovery since Q3 22, Fitch expects volumes to remain depressed over the forecast horizon," Fitch said. SI Group makes specialty chemicals used in coatings, adhesives, sealants and elastomers (CASE) as well as in lubricants, fuels, surfactants and polymers.

Amphistar is a fundraising juggernaut (my words not theirs) and I am happy to read more from them in press release as follows: Belgian biosurfactants developer AmphiStar has been awarded a new €2.5 million funding by SPRIND, Germany’s Federal Agency for Disruptive Innovation, to accelerate continuous manufacturing of its sustainable microbial biosurfactants. The highly innovative SPRIND program identifies and supports only the most transformative technologies in Europe. The SPRIND Circular Biomanufacturing challenge consists of 3 stages. In stage 2, six ambitious teams conducted techno-economic - and life cycle assessments, all while advancing the commercialisation of the biochemicals they are targeting. In stage 3, five teams will continue the challenge to produce three different products from waste in a 180 day continuous production. The SPRIND funding enables AmphiStar to advance its continuous fermentation technology and accelerate the commercialisation of new biosurfactant molecules from its expanding library, all of which are produced through the microbial upcycling of bio-based waste feedstocks into sustainable, market-ready ingredients. [There’s more but you get the idea. Much success to them!]

Last month we told you about the cutely named Upsycal silicone alternative products from a Pilot Chemical / Rikarbon collab. We wondered about the chemical identity and now Pilot used the tipline and provided the blog more information here https://pilotchemical.com/upsycal/ . Very nice. The 2 products are Pentyl Nonane and Pentyl Dodecane. There’s TDS’s there with flashpoint and viscosity data. It’s a very interesting market. Now we just need to see some spider charts and such. I’m sure they are on the way.

Also last month we wrote about a relatively new company, Viridi and their new CO2 based surfactants. Since then there was a spirited discussion, involving some of my favorite surfactant people, on Linkedin around a post by one of Viridi’s founders, here. So, I caught up with Dan Stewart, post author and Nick Smith, Commercial Director, for a chat over a video call. Here’s what I learned. :

· Viridi is a spinout from Southampton University, via an accelerator, about 4 years old. EQT (Sweden) is an early investor . 17 employees today.

· It’s primarily an IP company built around catalyst technology.

· After starting in polyols, they are now “95% surfactants” in terms of a target market.

· The business model is that of leasing catalyst to producers of surfactants (and hydrophobes). The catalyst enables the use of CO2 (from the air, obviously) to replace EO (or PO) in alkoxylates and to replace Carbon in the alkyl chain of either oleo or petro detergent range alcohols. Thus making a new hydrophobe. Existing production assets can be used.

· Cost to lease the catalyst? They’ll take a cut of the savings vs the prior traditional chemistry.

· Current scale. They talk in terms of catalyst produced and surfactant produced by partners / licensees. They’re looking at multiple tons of surfactant next year as partners progress – along with of course, registrations.

· So – what about the LI discussion? There were 2 major matters discussed. i) what about the chemical identity of the new hydrophobes and surfactants? Well (and I can sympathise) they are not ready to disclose due to ongoing registrations and patent fillings and such. I get it. ii) The level of anti-palm rhetoric in the article, some folks thought actually detracted from what was a really good and interesting message about building surfactants from CO2 (and I sympathise with that view also). Good news is that the company is engaging with all the folks on that thread and will even meet some in person in the coming weeks. Great. Some value will be created, I’m sure.

· So – let’s see. I’ll be following them, as I seek to do with anything new and interesting in our field.

Have you had enough news yet? I’m gonna check my Google alerts and see if there’s anything else..

Nope, looks like we got everything. So lets’ wrap with:

Market News:

In detergent range alcohols, Asia's fatty alcohols market faces downward pressure on mid-cuts due to increased supply from new plant startups, while long chain prices are revised upwards by elevated feedstock PKO costs, despite some shifts to cheaper alternatives. Overall demand is dampened by reignited US-China trade tensions. In the US, Q4 contract negotiations concluded with mid-cut prices increasing and long chain prices decreasing, as ample supply meets below-average demand during destocking. Tariffs continue to squeeze import margins. Europe's Q4 mid-cut fatty alcohol contracts firmed due to rising PKO costs and tight summer availability, but spot prices declined in October with improved supply and EUDR uncertainty. The EU Deforestation Regulation's implementation has been delayed again [see above], with revised compliance timelines for different company sizes, while a new trade deal between Indonesia and the EU aims to boost trade.

The Asian fatty alcohol ethoxylates market continues to experience downward price pressure, driven by declining feedstock fatty alcohol mid-cuts and ethylene oxide costs. Demand remains tepid, limited to needs-based sporadic activities amidst a bearish market sentiment and broader macroeconomic headwinds. Renewed US-China trade frictions, with escalating port fees, are further disrupting global supply chains and dampening market confidence, contributing to the likely near-term weakness in feedstock fatty alcohol prices and suppressing demand for surfactants.

The Asian linear alkylbenzene (LAB) market is experiencing slow demand, with buyers seeking lower prices while suppliers maintain offers due to constrained spot supply and upcoming plant maintenance. A significant buy-sell gap is hampering deals, particularly in Southeast Asia. India's market is softening as buyers anticipate lower November offers after previous increases. The downstream LAB sulphonate (LAS) market is stable with tapered demand. Looking ahead, maintenance across Taiwan and mainland China will keep spot supply snug, although a new Chinese line recently started up. The Asia benzene market faces downward pressure from ample supply and weak downstream demand, with crude volatility also weighing on sentiment. Production updates include a new line start-up by Fushun Detergent Chemical in China and delayed start-ups by others in the region.

Music Section

Last month, Alex Lifeson and Geddy Lee announced they would go back on tour, as Rush, with Anneka Nilles, an accomplished jazz-fusion drummer.

+++++++++++++++++++++++++++++++++++++++++++++++++++

“This is called Anthem.”

That’s what the elfin figure said back then on stage at Massey hall. Pronouncing the word oddly, memorably. On the studio version the music just started – out of the blocks – choose your metaphor – exploded? No, just ran – hard. First ratcheting up the tension, then releasing. Gaining momentum as it went – a flywheel. Virtuous. It was a shocking song, for good reasons. The first album had ended with a good, really good, long, rock song. Working Man. I guess that’s what I am. Then the weird, intense new guy joined the two goofy best friends and a transformation was wrought that would change many lives. Wrought? Yes. Wrought. That was an the important word and he wrote it deliberately. It was a pushing and bending of things that was painful but released beauty. The drums elevated the viewpoint. You could see greatness, even perfection, from here now. He brought words with him as well, inspired by thoughts, like they ought to be. We’re not rockin’ all night now baby!

“Yeah, let’s erm change it up a bit. I’ve got this song based on a book by Ayn Rand.”

“Who?”

“– Erm – an objectivist philosopher. Chick. From Russia.”

“Sexy Russian? Hur…hur…”

“Er…No. Pronounced kinda like iron. Wrought.”

“Well…OK then. Let’s give it a go.”

The new guy was strange. Better let him have this one. The new guy made everything good. Made everyone wonder.

Rory knew exactly what he was looking for and where to find it. In a box. He pulled it out between forefinger and thumb. The snowy owl, still serious, regarded him with a kind of expectation. What now? It was kinda like the samurai sword right – once you’d unsheathed it, but they weren’t quite there yet. He’d always thought the owl had a touch of the eagle about him. This wise one had purpose, intention. Snow covered the ground but beneath the noble bird was a patch of dry earth. As Rory looked again, now, he wondered if it was a crack. For 40 years or more, he’s assumed the bird was landing on a snow covered field on a convenient spot. Now though, maybe he was emerging from the earth, hmm… doubtful. Maybe a crack had appeared and it was time to fly. And his face said it – what now – what about you? It was funny though because it was a cartoon. The bird had big, clown, feet and the sky was purple. How come? The yellow eyes. The yellow eyes, that’s how come. Piercing and asking. What now, Rory? I’m flying. What about you? It was a reasonable question. The bird was built to fly and ask questions and be intentional. What about Rory. He thought he had a good answer. He’d done a lot since they’d last seen each other. He’d smashed his life, and some others, to pieces, and rebuilt – but maybe on sand? Too many metaphors. A crack was opening up and Rory had a question to answer. What now. Time to do what he was designed to do. Flying didn't mean running away. It meant alignment. It meant jigsaw-piece-clicking. It meant - ought to be. He indulged himself for one more moment. How many men his age had come to this point over the decades, listening to the new guy and the best friends, and thinking. How many acted. Wrought.

Well. He looked around the finished basement. There was a record player down here, of course there was. Time to unsheathe the sword. He plugged it in – Radio Shack – then spent half an hour looking for speakers and then another half hour looking for wires to connect them. In there with Jimmy’s toy soldiers, where else? He looked at the bird one more time – yes definitely an owl/eagle and turned it over. The three friends with the new guy in the middle as they would be forever after, in all the many possible worlds. After turning it back over, he held the cover, tilted it slightly down and pulled gently on the inner sleeve to tease out the monocolor drawings of a young idealist. Wrought. Then his favorite part. Left thumb on the thin black edge and the middle and ring fingers at the center as the paper slid over them. The words and images priming the listener for something they needed to be primed for. Rivendell, In the End, By-Tor. If 2112 changed everything, this unassuming work announced that change was coming. The John the Baptist of records. He wouldn't like that. Wasn't big on religion, like his philosopher. His flaw? Rory smiled. He wasn't one to cast the first, or any, stones.

He walked toward the plugged in, red lit, machine. Continuing the two handed operation like a pro, he found the hole in one shot and let the disc rest, then brought the needle up and over and, again in one shot, into the position that gave him enough time to give the music some space, to walk back a few steps. The three friends, well, two friends and the new guy, pushed four huge notes up a hill, work creating potential energy, releasing a convulsion of creativity. And did it again. And did it again. And did it again. And did it again. And did it again. Each time slightly different. Each peak slightly higher. Then a series of steps toward the plateau, way up there. Don’t let them bring you down. He stood, listening. It was a rock song and then some and then some more. Always giving more, decade after decade. Wrought. Echoed. Faded. 1-2-3, 1-2-3, 1234!

+++++++++++++++++++++++++++++++++++

When I heard Neil Peart died about 5 years ago, I was sad but I didn't actually cry. When I heard the news about the tour with a new drummer, I choked up. Not sure why.

Anyway here she is, Anneka: