Surfactants Monthly - July 2025

Surfactants Monthly – July 2025

Hey guys! What about amines used in surfactants? Check out our recent YT 5 minute video and be sure to read my comment underneath it:

We are next together, in person, as a group of creative surfactant devotees, at our eleventh (11th) Asian Surfactants Conference in Kuala Lumpur Malaysia on November 13 – 14th. https://events.icis.com/website/14105/home/. It’s the our 11th conference in Asia and we are cranking it up to 11 ! And, AND, AND it is 100% HRD Compliant. [My Malaysian friends know what this means. Let’s get to it!]

More News

Godrej of India, in a regulatory filing here (https://www.bseindia.com/xml-data/corpfiling/AttachHis/dd60b742-7d64-486c-877a-54a01a15ce83.pdf) noted it invest more than Rs 750 crore (that’s about USD 88 Million) over the next few years to expand capacities of its chemicals business and achieve higher annual revenue. The release goes on to read, in part: The company announced doubling of its Fatty Alcohol and Euric Acid capacities with an addition of 35,000 tons per annum and 20,000 tons per annum respectively. It has tripled its specialities capacity with an addition of 21,000 tons per annum while the glycerine capacity will be doubled with an addition of 24,000 tons per annum. The fermentation capacity will also see a threefold increase with an addition of 1,500 tons per annum. It plans to increase the Primary Surfactants capacity with an addition of 30,000 ton per annum. Additionally, to support the company’s sustainable operations, it will enhance its hybrid power capabilities thereby increasing renewable energy usage to 75 percent. [That’s a lot of capacity increases – including, it looks like, in biosurfactnants] . In the filing, Vishal Sharma, CEO of Godrej Industries, went on to note that this investment supported the goal of reaching USD 1 Billion revenues by 2030.

Go Godrej!

Always fascinates me what it’s possible to patent in what must be very mature and thoroughly patented fields with so much prior art. Reckitt has patented a laundry detergent formula based on nonionics with some biocidal quat in there. Seems unlikey but here it is (link) – Not sure how significant it is.

I was happy to read in my well-thumbed copy of the UK’s Grocer Magazine, their comments on Unilever’s recent purchase of Dr. Squatch: In a strategic shift, Unilever is focusing on premium brands in the beauty and personal care sectors. The company recently acquired natural soap maker Dr. Squatch and deodorant brand Wild. This is part of a larger strategy under new CEO Fernando Fernandez to move into higher-margin products. Unilever's new direction also includes selling off food brands. The company has already sold The Vegetarian Butcher and is in the process of spinning off its ice cream division, which includes Magnum. It is also looking for a buyer for Graze and is expected to auction brands like Marmite and Pot Noodle. The goal is to increase the share of premium brands in its portfolio from 35% to 50%. Unilever acquired U.S.-based Dr. Squatch for a reported $1.5 billion. It hopes to grow the brand, which is known for its viral marketing, both in the U.S. and internationally.

However, the article notes there are risks. A key challenge will be maintaining Dr. Squatch's "playful edge and outsider authenticity" within the large corporate structure of Unilever [hmm yes – see my comment at the end]. The company has a mixed history with similar acquisitions. For instance, Dollar Shave Club, which was purchased for $1 billion in 2016, was later sold in 2023 after disappointing results. Another acquired brand, REN Clean Skincare, is set to be shut down.

[So we here at the blog will be keeping a close eye on how UL rides the Squatch marketing tiger, especially in light of the even greater media attention added to the already rabid coverage of their soap spokesperson. I’m rooting for UL. They wanted social first marketing so… ]

As reported in HAPPI (which you should read every month like I do), Native (the deodorant company which has been part of P&G for about 8 years now), no doubt inspired by Touchland, who we reported on recently, is extending into the hand care category with the launch of its new Liquid Hand Soap. Officials say the launch marks a new chapter for the brand, bringing its “clean” formulas beyond the shower stall and into every room in the home. As high as 82% of Native users asked for it – making the launch the most requested product drop to date. [I find it hard to get excited about handsoap, but many folks do – so…]

EUDR is still… Europe’s Dumbest Regulation and APAG, the oleochemicals group along with ten other trade associations, including CESIO, has written joint letter to the European commission to tell them so. Here’s the link. Well actually they are not so impolite. In fact I think they are a bit too polite – maybe in private they will tell it like it is. The key points are here and I quote “We urgently call on the European Commission and Member States to (1) provide clear and public communication on the expected timeline for EUDR implementation (clarify whether any amendments, delays, or simplifications are under consideration), (2) offer workable, practical guidance that enables businesses to continue preparing in a legally sound and commercially viable manner, and (3) ensure that the FAQs and guidance documents disseminated by the EU Commission for implementation purposes are met with consistent acceptance across all 27 Member States and their competent authorities. Additionally, it is crucial that any emergent interpretations are exclusively channelled via the EU Commission to uphold uniformity in understanding and application.”

BASF: Did you know they sold enzymes? I kinda did but didn't fully appreciate the nautrte of the business. They sell into HI&I – alongside the more traditional surfactants. They’ve expanded their range of liquid enzymes under the Lavergy® brand. [I have to say, I’m not thrilled with the brand name, have to be honest. But probably just me]. [Hey – love you guys – you know that!] Read more here.

As I read in my (you guessed it) well-thumbed copy of EU Startups magazine: Belgian BioTech developer AmphiStar secured €12.5 million for clean biosurfactants. So we love Amphistar here at the blog and have been following (and talking to) them since they were just a project at the University of Ghent (Great things coming out of Ghent BTW). The article tells us in part that the company has secured €12.5 million in funding following the European Innovation Council’s (EIC) latest evaluation round, in order to speed up the production of sustainable microbial biosurfactants, upcycled from a bio-based waste feedstock, and ultimately bring them to market. The blended funding takes the form of a €2.5 million grant and a €10 million equity investment. AmphiStar is one of 40 selected beneficiaries sharing nearly €230 million in support, all recognised for their innovative technologies with strong commercial potential. The new funding follows €12 million previously raised through CBE-JU projects (Waste2Func, SurfsUP), regional grants (VLAIO) and the support of the German SPRIN-D and Ghent based Biotope in addition to a pre-Series A funding round closed in 2024 by three VC funds (ECBF, Qbic, PMV). Go guys!

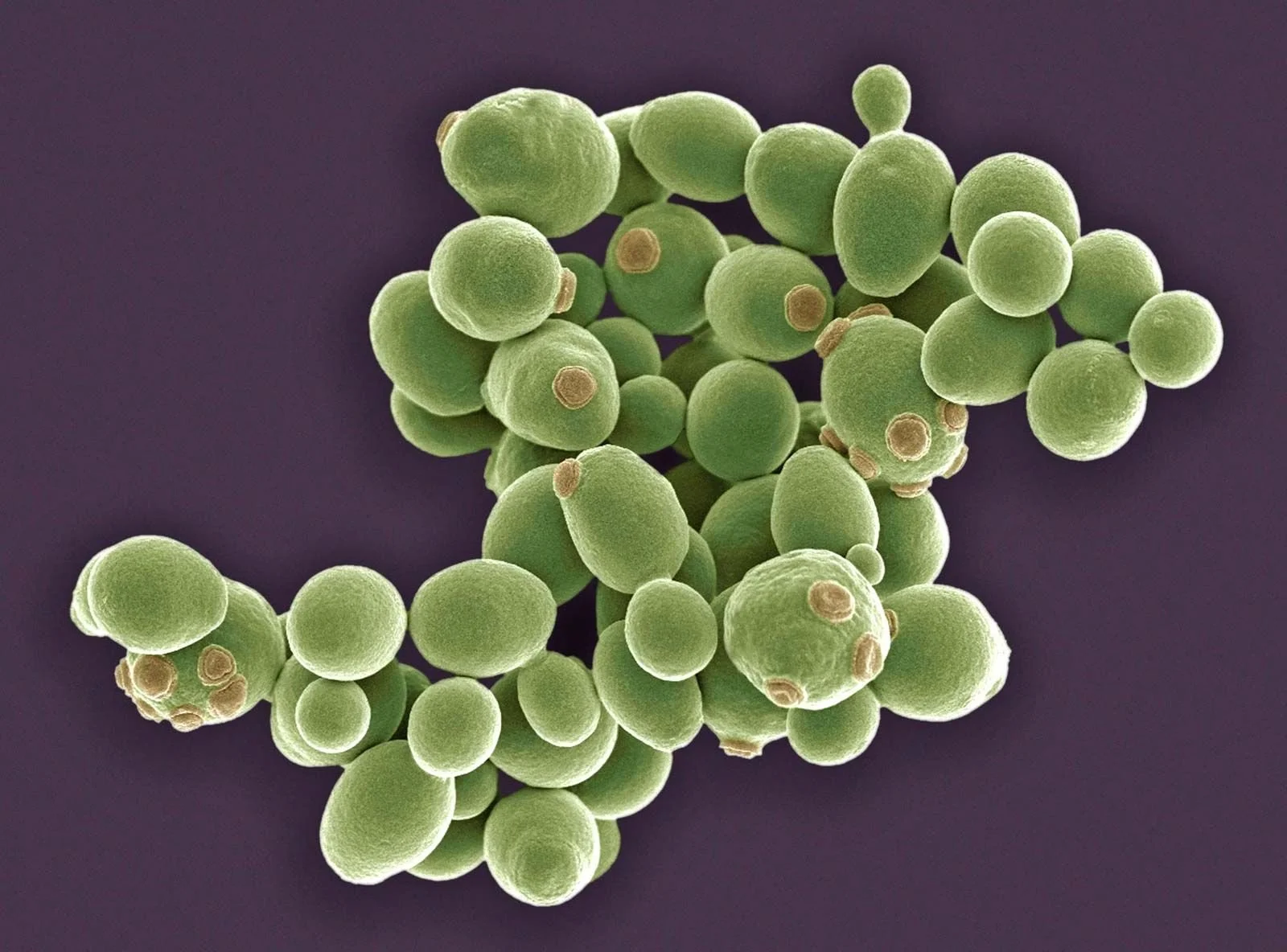

We’ve written a bit about Ruby Bio here and they’ve appeared at my conferences a few times. We get a bit of the back story in a publication from the UC Davis College of Agricultural and Environmental Sciences here. Among other things the article notes that yeast technology developed at the lab there has been licensed to Ruby Bio, a San Francisco Bay Area company focused on biomanufacturing for consumer goods. …. the company has found these glycolipids, when used in products, are gentle on the skin and work better than some common cleaning agents. They're now ramping up production and preparing the compounds for commercial use. Ruby Bio expects to see the yeast-based ingredients in products such as laundry detergent, dish soap and shampoo within the next year.

And green too

We’ve written periodically about P&G’s work with palm smallholder here. The Centre of Sustainable Small-owners (CSS), a collaboration between the Asia School of Business, Procter & Gamble (P&G), and the Temasek Foundation, has released its CSS Impact Report 2025 here, describing its work with smallholders in Malaysia. It makes interesting reading. Smallholders contribute over 40% of the world’s palm oil supply for one thing. To date, 892 smallholders have been RSPO-certified, with some achieving yield improvements of 20%–25% over two to three years, and up to 35% over four years. A total of 407 certified smallholders received US$68,175 in sustainability-linked premiums between 2021 and 2024. Nice!

Last month, we wrote about the new Rheance D-50 rhamnolipid from Evonik and wondered how it may differ from the original Rheance One. It looks like the products themselves are very similar (same INCI name and same preservative.) Rheance D-50 seems to be more targeted at cosmetics. It notes makeup removal and sebum removal under “Technical Features”. Under “Branding Values” D-50 is noted as cruelty free and vegan suitable. Whereas Rheance One does not have this notation. Instead it says - China IECIC / IECSC registered. So I think that explains the key differences.

Indovinya continues its march toward an IPO. They announced a $1.5 billion syndicated loan to refinance debt and strengthen capital structure ahead an expected IPO. A syndicated of eight banks put this together: including Mizuho Financial Group, Bank of China (Hong Kong), Oversea-Chinese Banking Corporation Limited (OCBC), The Siam Commercial Bank Public Company Limited, Kasikornbank Public Company Limited, Sumitomo Mitsui Banking Corporation, DBS Group, and Australia and New Zealand Banking Group Limited.

As reported in the Wall Street Journal, Reckitt Benckiser is selling a majority stake in its home-care business, home to Air Wick fresheners and Cillit Bang cleaning products, to Advent International in a deal that values the whole unit at up to $4.8 billion including debt. Some storied brands involved include Mortein, Calgon, Woolite, Resolve, Sole, and Easy-Off, along with 75 others in more than 70 markets. Good luck to the new owners. !

The news just doesn't stop. P&G has a new CEO as if January 1st 2026. He is Shailesh Jejurikar. Long time proctoid since 1989. We wish him the best of luck. !

Natural claims under ISO 16128? I read a nice article on Linkedin explaining how this works, recently. Check it out. It’s by blog reader Ashely Quigley of Surfachem.

In their Q2 Earnings report, Stepan grew sales and income overall but missed forecasts. EBITDA for surfactantsd dropped Q on Q by 1%. The company reported its Q2 2025 earnings, revealing an earnings per share (EPS) of $0.52, falling short of the forecasted $0.90. The revenue for the quarter reached $594.69 million, slightly below the expected $598.25 million. The stock reacted negatively to these results, with shares dropping 8.8% to $55.24 in pre-market trading.

Revenue: $594.69 million, slightly below forecasts.

Earnings per share: $0.52, compared to a forecast of $0.90.

Adjusted net income: $12 million, up 27% year-over-year.

Adjusted EBITDA: $51.4 million, up 8% year-over-year.

A fair amount of discussion in the earnings call focused on cost increases. Stepan Company is facing significant increases in raw material costs, particularly for oleochemicals like coconut oil, which has tripled in price over the last 18 months. This has put pressure on surfactant margins. To address this, the company is implementing price increases to pass on the higher costs to customers, with a recent price adjustment made at the end of June. Stepan is also focused on improving its product and customer mix and expects its new, fully operational Pasadena, Texas facility to contribute to supply chain savings and volume growth, further helping to offset the inflated costs. The company's leadership expressed confidence in their ability to gradually recover from the raw material inflation throughout the second half of the year through these strategic pricing and operational initiatives. OK – let’s see! Times are certainly tough and somewhat unpredictable.

Meanwhile Syensqo reported a decline in Q2 sales and earnings year on year due to lower sales volumes and negative foreign exchange impacts. EBITDA fell by over 11%, while sales dropped by more than 7%. Despite these challenges, CEO Ilham Kadri noted an 8% sequential improvement in EBITDA from Q1. The company faced a 4% negative impact from unfavorable foreign exchange movements as the euro strengthened. Syensqo reaffirmed its full-year outlook, expecting underlying EBITDA of approximately €1.3 billion for 2025, and plans to implement cost-cutting measures to achieve €200 million in savings by the end of 2026.

If you’ve got the sense that you’ve been reading a lot about plant closures recently, especially in Europe, you’re right. You can keep up to the minute on the topic page that ICIS maintains here . In particular, Dow is closing three in Europe and in the Americas, an ethylene glycols plant at Seadrift, TX (to focus on purified EO), propylene glycols at Freeport, TX and polyether polyols at San Lorenzo, Argentina.

Having trouble keeping track of various US state regulations affecting cosmetics and their ingredients (including dioxane), then check out this (free – for now) interactive map from the Independent Beauty Association (IBA). Very cool.

The great HAPPI alerted me to more bottle-free, water-free innovation from P&G in the form of Gemz shampoo and conditioners. Check it out here https://www.shopgemz.com/ THe products are available at Target here . More cool innovation in the footsteps of EC-30 and Evo. OK , but what about the ingredients. Well first up is :

Hydration lock shampoo: sodium laureth sulfate, polyvinyl alcohol*, sodium c10-16 alkyl sulfate, cetyl/lauryl/myristyl hydroxysultaine, citric acid, sodium bicarbonate, fragrance, bis-aminopropyl dimethicone, water, guar hydroxypropyltrimonium chloride, acacia senegal gum, sodium benzoate, monosodium citrate, polyquaternium-76, yellow 5, red 33 *water soluble, biodegradable polyvinyl alcohol.

Perfect air dry shampoo: sodium laureth sulfate, polyvinyl alcohol*, sodium c10-16 alkyl sulfate, cetyl/lauryl/myristyl hydroxysultaine, citric acid, fragrance, sodium bicarbonate, bis-aminopropyl dimethicone, water, guar hydroxypropyltrimonium chloride, acacia senegal gum, sodium benzoate, monosodium citrate, polyquaternium-76, blue 1, yellow 5 *water soluble, biodegradable polyvinyl alcohol.

The rest seem pretty much the same basic formula.

The conditioners have the following basic formula : stearyl alcohol, behentrimonium methosulfate, pvp, cetyl alcohol, lauroyl/myristoyl/methyl glucamide, isopropyl alcohol, propylene glycol

Interesting right? I wish them much success.

Hey someone buy them and send me a review !

Personnel news: Carmen Masciantonio is to succeed John Paro as CEO of Hallstar. More details in HAPPI here.

Finally some interesting news from our friends at Econic. They have signed a deal with PTT of Thailand. Check this out:

Thailand’s PTT Global Chemical (GC) is deepening its collaboration with the UK’s cutting-edge cleantech ecosystem. GC has signed an MOU with Econic Technologies Ltd, a UK-based carbon-to-value pioneer, and allnex, a leading global resin producer, to jointly explore advanced polymer systems made from captured CO2. This exciting partnership will focus on developing low-carbon, high-performance coatings and materials for a more sustainable future. The collaboration builds on GC’s strategic investment in Econic Technologies, reinforcing GC’s commitment to innovative carbon utilisation and the circular economy. It’s yet another example of the deepening relationship between the UK and Thailand on net zero, technology and investment.

Market News:

In detergent range alcohols elevated feedstock palm kernel oil (PKO) prices are creating divergent trends in the global fatty alcohols market. In Asia, mid-cut C12-14 prices are on an upward spiral, supported by high PKO costs and restocking demand from China and India. In contrast, demand for long chains has weakened, putting downward pressure on their prices and prompting producers to seek better margins on mid-cuts. While PKO prices remain high, there are signs their upward momentum is slowing. Meanwhile, US buyers are bracing for an upcoming tariff deadline, having stockpiled material in anticipation of a margin squeeze. This, combined with rebounding PKO costs, is creating upward price pressure, which was reflected in higher third-quarter contract settlements. A potential reduction in US tariffs on Indonesian imports is being closely watched. In Europe, spot prices are firming in response to the PKO cost surge, narrowing the arbitrage with Asia. A significant development is the agreed US-EU trade deal, which spared fatty alcohols from retaliatory tariffs. In contrast to the firming spot market, third-quarter contract prices settled stable-to-soft, marking the first softer pricing trend in several quarters.

The Asian fatty alcohol ethoxylates (FAE) market is experiencing upward price pressure, driven by a relentless surge in feedstock fatty alcohol mid-cut costs. Spot offers for FAE have been revised upward, tracking the rising feedstock prices. However, demand remains tepid, with spot business limited to small, need-to-basis parcels, while most trades are for term shipments. The market outlook is cautious, with players awaiting clarity on US tariffs and sentiment dampened by macroeconomic headwinds and geopolitical tensions. Feedstock prices are believed to be nearing their peak. In Southeast Asia, spot offers were raised, but buying interest was limited. In China, spot FAE prices were adjusted higher, though official data indicated a weakening of factory activity, with both supply and demand slowing down. Upstream, Chinese domestic ethylene oxide prices were flat amid ample supply and weak demand.

The Asian linear alkylbenzene (LAB) market remained propped up by tight spot availability, with suppliers targeting higher prices, supported by rising raw material costs. Ongoing and upcoming maintenance shutdowns are expected to provide limited relief to the snug supply situation in the near term. While demand has tapered due to the slower third-quarter season, the tight supply has continued to provide an upward impetus to the market. In India, participants are awaiting new domestic offers, with tight import and local availability fueling expectations of higher prices. The downstream LAB sulphonate (LAS) market in Southeast Asia remained lackluster with low demand.

Spot prices for LAB in Northeast Asia and Southeast Asia were firmer compared to four weeks ago. In Northeast Asia, Chinese spot exports were limited and domestic prices were unchanged. In Southeast Asia, some sellers revised offers upward. The LAS market saw buyers asking for discounts, but sellers were not keen to reduce offers given the buoyant upstream LAB sector. Upstream, benzene prices were up for the third consecutive week. In production news, a Thai LAB facility remains shut for maintenance, and a Chinese plant is planning a shutdown from August.

Music Section

Steven McCue took my Dindy C-90 cassette home and the very next day came back to school with Black Sabbath (the album) on one side and Paranoid (the album) on the other. I wore it out in the following months, playing it usually during homework – maths mostly. Not sure why. It was probably just as well it was a copy as when I saw the actual cover of that eponymous first album in the record store behind the bus station in Sunderland it was, to me, at the time, scary AF.

And the lyrics.

Big black shape with eyes of fire

Telling people their desire

Satan's sitting there, he's smiling

Watching those flames get higher and higher

Oh, no, no, please, God, help me

I was just getting used him wandering through the world seeking the ruination of souls – and now this!

They created a genre that has lasted half a century. I’ve told you this story in the blog before but, since then I think we’ve got 10X the readers so.. I was holding an offsite for my management team in a prior life at a co-working facility some years ago. The young college-age lady at the front desk asked me what type of music I liked as she could play whatever we wanted in the break area. Very cool. I said, for me personally, I like heavy rock 70’s / early 80’s but the group’s too intellectual for that so we should play it safe with jazz. Well, she confessed to being a heavy afficionado too. Like what? Oh like Metallica, Iron Maiden, Black Sabbath. Really? Bit young for Sabbath aren’t you? Oh no – all the freaks like Sabbath. Still not fully buying this, especially as she was not conforming to my idea of a freak, I asked for her favorite Sabbath song, expecting all of them as the answer. War Pigs, of course and Into the Void. Go figure!

As I went through this month’s selection of videos, that episode came to mind. War Pigs is a timeless song, as we will see together.

First up my favorite live version of the song from 1970. Check out Bill Ward, who’s beating those drums like they owe him money!

Now some covers:

Can you believe this? Ronnie James Dio recorded a cover in 1972 with his band, Elf. I’m not going to explain why this is significant, if you don't know.

And of course, those first disciples of Sabbath, Judas Priest have played the song many times. Here’s a very recent one.

OK so far, so faithful, but the song has appealed to all sorts of different folks around the world.

Now, check out uKanDanZ singing in Ehiopian!

You may know this one: T Pain

Stay with me. It’s gets ever more interesting. Cake. What style would you call this? Disco? Funk. I dunno. Not a bad vocal though.

Ah but talking of vocals – this girl’s got pipes and she knows how to use them. Maya Azucena and a nice brass section. You know I love the YT comments: she went big. this is a song where you gotta go big or go home. bravo.

Swedish folk singers? Yep we got ‘em right here. Harmonizing nicely.

This guy is weird and I don't like him. But here he is.

Apparently 1,000 people played this together in a stadium in Portugal

There are many more and so this is not an exhaustive list.

And finally, this is an interesting mashup by the DJ Girl Talk, of War Pigs and Move ***** by the rapper, Ludacris. Caution! Don't listen to this at work. There are bad words in here that may draw the attention of your HR manager if she is not otherwise occupied at some Coldplay event. Oh man – that was a lot of work to get to a “joke” that wasn't even really that funny. OK – listen to it though (Not at work!). By the way - around the 4:30 mark – a little Blitzkrieg Bop, another blog favorite.

So – which cover was your favorite? Keen to hear from our avid music readers.That’s it. See you very soon for Asian Surfactants XI (that’s Eleven). https://events.icis.com/website/14105/home/

HRD Compliant Baby !! Bayi Patuhi HRD !!